Imagine half of every federal dollar sent to help Minnesota’s most vulnerable vanishing into thin air. That is the nightmare scenario emerging now, as prosecutors reveal a staggering $9 billion could be missing from state coffers.

It began with a pandemic meal scam but has exploded into what First Assistant U.S. Attorney Joe Thompson calls “industrial-scale fraud,” with investigators uncovering new $50 million theft rings so often it has become routine.

Prosecutor’s Chilling Admission

“Every day, we look under a rock and find a new $50 million fraud scheme.” That chilling admission from First Assistant U.S. Attorney Joe Thompson captures the relentless scope of the theft. Authorities aren’t just finding isolated criminals; they are uncovering a machine.

The investigation has already swept up 90 defendants, yet officials warn they are merely scratching the surface of a scandal that has compromised Minnesota’s entire social safety net.

From Pandemic Relief to Organized Looting

What started in 2018 as opportunistic theft metastasized into an organized criminal enterprise during the COVID-19 pandemic. As billions in federal relief flooded Minnesota, fraudsters saw an open vault. The initial $250 million theft from the Feeding Our Future meal program was just the prologue.

Investigators now say that the scheme was merely the training ground for sophisticated rings that pivoted to exploiting Medicaid, housing assistance, and therapy services.

Autism Therapy Funds Weaponized Against Children

Schemes allegedly targeted the Early Intensive Developmental Behavior Intervention program, treating therapy hours for disabled kids as blank checks. Providers recruited families from Minneapolis’s Somali community, often paying kickbacks to parents to enroll their children, then billed the state for millions in services that were never delivered.

Real therapy for vulnerable children was replaced by phantom billing and cash payouts.

Criminals Flocked to Minnesota

The “easy money” atmosphere in Minnesota became an open secret in the criminal underworld, sparking a wave of “fraud tourism.” First Assistant U.S. Attorney Thompson revealed that the Housing Stabilization Services program became so porous that criminals traveled from other states specifically to exploit it.

Two Philadelphia residents allegedly collected $3.5 million, treating Minnesota’s social services like an unprotected bank vault after hearing the state was a soft target for theft.

The Scandal That Broke the Dam

Feeding Our Future serves as the “patient zero” of this epidemic. The nonprofit is central to the scandal, with 78 individuals charged for stealing $250 million intended to feed hungry children. Founder Aimee Bock was convicted for overseeing a massive operation that submitted fake meal count sheets for tens of thousands of nonexistent children.

The sheer audacity of this scheme exposed how state agencies approved payments despite early red flags.

Conviction Rate Hits 67%

Federal prosecutors are fighting back with methodical precision, securing convictions for nearly 60 of the 90-plus individuals charged so far—a conviction rate of roughly 67 percent. These aren’t just plea deals; the Justice Department is winning complex jury trials, proving that defendants used stolen taxpayer funds to buy luxury vehicles, lakeside homes, and overseas real estate.

Yet, for every conviction, investigators seem to uncover another layer of financial corruption.

Somali Community Caught in the Crosshairs

The fallout has landed heavily on Minnesota’s Somali community, the largest in the U.S., as approximately 89 percent of those charged in the meal scam are Somali Americans. Community leaders report that honest families are now facing suspicion and stigma due to the actions of a criminal few.

Federal officials insist they are targeting behavior, not ethnicity, but the demographic data has fueled intense political and social scrutiny across the state.

Governor Walz Under Fire as Billions Evaporate

Governor Tim Walz finds himself in a political firestorm, defending his administration against accusations that it left the vault door open. Critics argue the state failed to protect taxpayer dollars, allowing fraud to fester for seven years.

Walz has pushed back, hiring outside auditors and appointing a program integrity director, declaring, “We will not tolerate fraud.”

Feds Surge Agents to ‘Tip of the Iceberg’

The crisis has triggered a massive federal response. FBI Director Kash Patel surged investigative resources to Minnesota even before recent headlines broke, recognizing the unprecedented scale of the theft. Agents from Homeland Security and ICE have joined the fray, focusing on the intersection of fraud and immigration violations.

Officials describe the current charges as just the “tip of a very large iceberg,” indicating that the investigation is far from complete.

Fraud As A Business Model

This wasn’t just theft; it was an industry. Minnesota Inspector General James Clark told lawmakers that “fraud has become the business model” for greedy actors who learned to game the system. A legislative audit confirmed that systemic failures inside state agencies allowed this business model to thrive.

Officials missed opportunities to stop the bleeding early in the pandemic, approving payments to entities that existed solely to siphon government funds.

One Clinic, $31 Million in Suspicious Billings

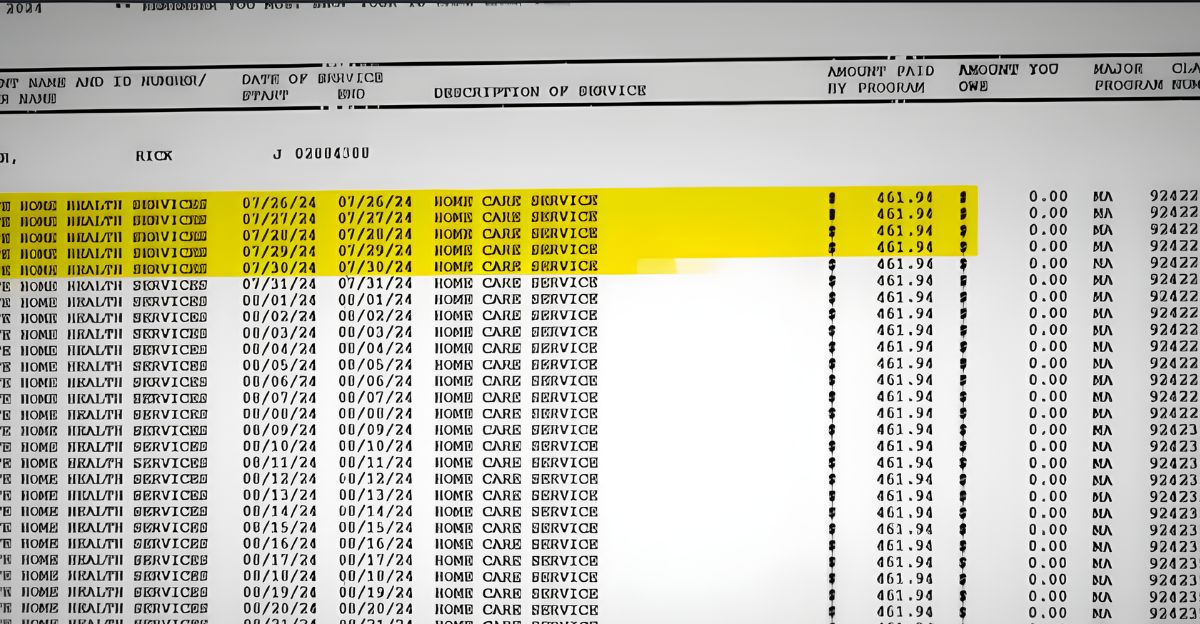

The case of Smart Therapy Center illustrates the sheer volume of the theft. Run by convicted fraudster Asha Farhan Hassan, the center submitted a staggering $31.8 million in claims across state programs.

While not all were paid, the audacity of a single clinic billing such massive amounts for autism services went unchecked for too long.

Trump Freezes Funding

The scandal has exploded onto the national stage, with President Donald Trump labeling Minnesota a “hub of fraudulent money laundering.” The administration took the drastic step of freezing child care funds to the state, citing “obvious fraud that seems to be widespread.”

This move politicized the investigation further, with Republicans demanding answers for the lost billions while Democrats accused opponents of weaponizing the scandal to target the Somali diaspora and damage Walz.

Payments Paused to Stop the Bleeding

In a race to stem the losses, Governor Walz ordered a pause on payments to 14 Medicaid programs identified as high-risk. A third-party firm, Optum, was brought in to manually review claims before funds are released—a desperate stopgap measure.

This freeze aims to catch fraudulent billing before the money leaves the treasury, but it also risks delaying legitimate payments to honest providers who are struggling to stay afloat amid the crackdown.

The Shell Game

Investigators discovered that fraudsters weren’t just hitting one program; they were diversifying. Thompson noted that many suspects operated multiple entities, “each of which seems to be created to bill a specific Medicaid program.”

If authorities tightened security on meal programs, the rings shifted to housing. If housing came under scrutiny, they moved to autism therapy. This specialization allowed criminals to stay one step ahead of slow-moving bureaucratic oversight.

The Struggle to Recover Cash

Despite the fanfare of seizures, the financial reality is grim. Prosecutors have recovered approximately $60-70 million in cash and assets—less than one percent of the estimated $9 billion stolen. While agents have seized mansions and luxury cars, much of the money was quickly laundered through complex international transactions or spent.

Thompson frankly admitted that full restitution is impossible, leaving taxpayers to shoulder the burden of the massive loss.

Whistleblowers Silenced?

Did state officials ignore warnings? House Oversight Committee Chairman James Comer has launched an investigation into whether the Walz administration retaliated against whistleblowers who tried to sound the alarm.

The committee is demanding documents to determine who knew what—and when. This congressional probe adds a dangerous new dimension for state officials, pivoting the focus from “who stole the money” to “who let it happen”.

AI Deployed to Hunt Down Anomalies

With human oversight overwhelmed, Minnesota is turning to machines. Governor Walz announced plans to deploy artificial intelligence to detect billing anomalies that human auditors missed. The new system scans for providers whose billing patterns are “not common or expected,” flagging outliers before checks are cut.

It represents a shift from reactive prosecution to proactive prevention, attempting to close the technological gap that allowed fraudsters to run wild.

The ‘Easy Money’ Era Ends

The era of “easy money” in Minnesota appears to be coming to a close, but the damage has already been done. Programs designed to feed children and house the homeless have been gutted by theft, and public trust has been shattered.

For the families who truly needed help, the tragedy isn’t just the lost money—it’s the lost opportunity for support.

The Investigation Expands

The most disturbing part of this story is that it has no ending yet. With 14 programs under active investigation and new charges dropping regularly, the scandal continues to grow. “Every day, we look under a rock,” Thompson said, and every day they find more.

As the probe digs deeper, Minnesota braces for more arrests, more shocking dollar figures, and the realization that the $9 billion estimate might still be low.

Sources:

“How Fraud Swamped Minnesota’s Social Services System,” The New York Times, November 29, 2025

“Minnesota fraud case is biggest among many multimillion-dollar pandemic scams,” CBS News, December 11, 2025

“Prosecutor: Billions Stolen From Minnesota Federal Aid Programs,” Newsmax, December 17, 2025

“U.S. Attorney estimates $9B may have been lost in Minnesota social services fraud,” YouTube/U.S. Attorney’s Office Press Conference, December 18, 2025

“Feds: Fraud total could top $9 billion,” Axios Twin Cities, December 19, 2025

“‘Tip of a very large iceberg,’ Feds surge response to Minnesota fraud investigations,” ABC News, December 29, 2025