Thousands of car buyers who confidently signed paperwork are now racing to sell within a year. A massive iSeeCars study analyzing 18.5 million vehicle sales reveals that luxury brands dominate the first-year resale rankings, with turnover rates reaching 28%.

Premium badges promised satisfaction but delivered depreciation, reliability concerns, and rising ownership costs. What looked like a dream purchase quickly became a financial regret. Here is what the data reveals. Let’s look closer.

What’s Actually Happening Here

Luxury vehicles are being resold at unprecedented speeds, often within 12 months of purchase. iSeeCars data shows the average first-year resale rate is 3.6%, yet several luxury models exceed 20%. These owners are not upgrading. They are escaping. Rising insurance, premium fuel, and rapid depreciation hit quickly. Many buyers underestimated ownership costs and reacted fast once bills arrived. The reasons become clearer when patterns emerge.

Why Luxury Buyers Feel Trapped

Luxury shoppers often stretch budgets, believing prestige ensures quality and satisfaction. Entry-level luxury models attract buyers moving up from mainstream brands. The sticker price appears manageable, but the actual ownership costs tell a different story. Insurance premiums surge, dealer service prices shock, and depreciation accelerates. These pressures appear within months, not years. Once buyers realize the math no longer works, resale becomes a matter of damage control rather than preference.

Depreciation Hits Like A Wall

Luxury depreciation is immediate and severe. Mainstream vehicles typically lose 15% to 20% in year one. Luxury vehicles drop 16% to 28%. A $75,000 purchase can lose $15,000 before the first service visit. Owners expecting long-term value feel blindsided. Being underwater on a loan creates a sense of urgency. Selling early feels safer than continuing to absorb losses. That urgency defines many resale decisions.

Reliability Doubts Appear Early

High prices create high expectations. Many luxury owners report quality concerns within months. Electrical faults, suspension issues, and software glitches appear sooner than expected. Once warranties end, repair costs escalate rapidly. Even routine maintenance becomes stressful. Forums and mechanic reports show consistent patterns across brands. Owners do not wait for catastrophic failure. They sell at the first sign of trouble to limit exposure.

Electric Vehicles Add New Pressure

Luxury EVs introduce another layer of regret. Rapid technology changes cause values to drop fast. Early adopters face sudden price cuts, faster depreciation, and infrastructure frustrations. Software updates and charging limitations often lead to dissatisfaction. Even when vehicles perform well, resale values collapse. Owners feel punished for buying early. That disappointment fuels rapid exits, even in the absence of mechanical failure or reliability concerns.

Meet The Cars Owners Abandon Fastest

Using VIN-level tracking, iSeeCars identified vehicles resold within 12 months at alarming rates. First-year turnover ranges from 13% to 28%, significantly higher than the 3.6% market average. Most are luxury brands. Some are electric. All share one outcome: buyer regret. These are not isolated stories. They are measurable trends backed by millions of transactions. The list begins with a clear outlier.

#1 – Land Rover Discovery Sport

The Land Rover Discovery Sport boasts a remarkable 28.3% first-year resale rate. Nearly eight times the market average. Starting around $55,188, owners report reliability concerns and steep depreciation immediately. Maintenance costs rise quickly, eroding confidence. Many buyers fear long-term ownership will magnify losses. Selling early becomes a defensive move. No other vehicle shows regret this concentrated or this fast.

#2 – Porsche Macan

The Porsche Macan averages $77,727 and carries a 22.2% first-year resale rate. Buyers love the badge but struggle with ownership costs. Insurance, maintenance, and premium parts quickly overwhelm expectations. Routine service feels expensive. The excitement fades once monthly costs settle in. Many owners realize the lifestyle does not justify the expense. Prestige alone cannot offset financial strain for long.

#3 – Mercedes-Benz GLB

The Mercedes-Benz GLB posts a 21.2% first-year resale rate. Its $50,627 average price attracts buyers stretching into luxury for the first time. Dealer-only service, premium fuel, and insurance costs arrive fast. Financial pressure builds quickly. Owners admit emotion drove the purchase. Practical realities end it. The GLB shows how entry-level luxury often carries full luxury expenses.

#4 – Mercedes-Benz CLA

With a 20.4% first year resale rate, the Mercedes-Benz CLA defines buyer remorse. Starting near $50,627, it promises accessible prestige. Ownership delivers premium fuel, insurance shocks, and costly maintenance. iSeeCars data shows financial stress drives many resales. The vehicle itself is not deeply flawed. The economics are. Buyers realize too late that affordability ends at the showroom door.

#5 – Mercedes-Benz GLA

The Mercedes-Benz GLA records a 16.7% first year resale rate. Younger buyers and first time luxury owners dominate its sales. Many underestimate insurance, maintenance, and depreciation. Costs surface early. Expectations of value collide with reality. Owners expected luxury to feel rewarding. Instead, they encounter constant reminders of expense. The GLA reflects broader issues across entry level luxury segments.

#6 – Range Rover Evoque

The Range Rover Evoque averages $58,492 and shows a 16.4% first year resale rate. Buyers expect durability and prestige. Reliability concerns emerge early. Owners fear long term repair costs reaching $15,000 to $25,000 over five years. Many exit before warranties expire. Emotional appeal fades when financial risk becomes clear. Prudence replaces brand loyalty faster than expected.

#7 – Mercedes-Benz C-Class

The Mercedes-Benz C-Class averages $56,370 and sees 14.0% resold within a year. Buyers enter luxury expecting refinement and value. Instead, they encounter premium fuel, insurance hikes, and fast depreciation. Reliability does not clearly surpass cheaper rivals. Owners feel the brand promise falls short. Selling becomes acknowledgment that prestige alone does not justify sustained ownership costs.

#8 – Land Rover Discovery

The Land Rover Discovery averages $77,163 and posts a 13.6% first year resale rate. Buyers expect rugged luxury. They encounter quality concerns and costly repairs instead. Depreciation accelerates anxiety. Owners fear staying longer will compound losses. Selling early feels strategic. Its presence alongside the Discovery Sport suggests issues extend across the brand, not individual models.

#9 – BMW 5 Series

The BMW 5 Series shows a 13.4% first year resale rate and nearly 49.8% depreciation over three years. Owners face rising maintenance costs after warranty expiration. Premium positioning fails to protect value. Many feel the price outweighs benefits. Even loyal buyers reconsider. The 5 Series illustrates how traditional luxury sedans struggle to justify modern ownership economics.

#10 – Jaguar F-PACE

The Jaguar F-PACE closes the list with a 13.3% first-year resale rate. Priced above $60,000, it combines depreciation with reliability concerns. Owners worry costs will escalate quickly. Selling early limits exposure. Jaguar’s premium image cannot offset uncertainty. The F-PACE shows that heritage alone no longer guarantees buyer confidence or long-term commitment.

A Pattern That Keeps Repeating

Nine out of ten of the fastest resold vehicles are luxury models. This is not a coincidence. Entry-level luxury buyers stretch budgets and face full luxury expenses. Depreciation, insurance, and maintenance converge quickly. Selling early becomes financial triage. The luxury ecosystem itself encourages fast exits. Prestige no longer guarantees satisfaction. Buyers are responding with their wallets.

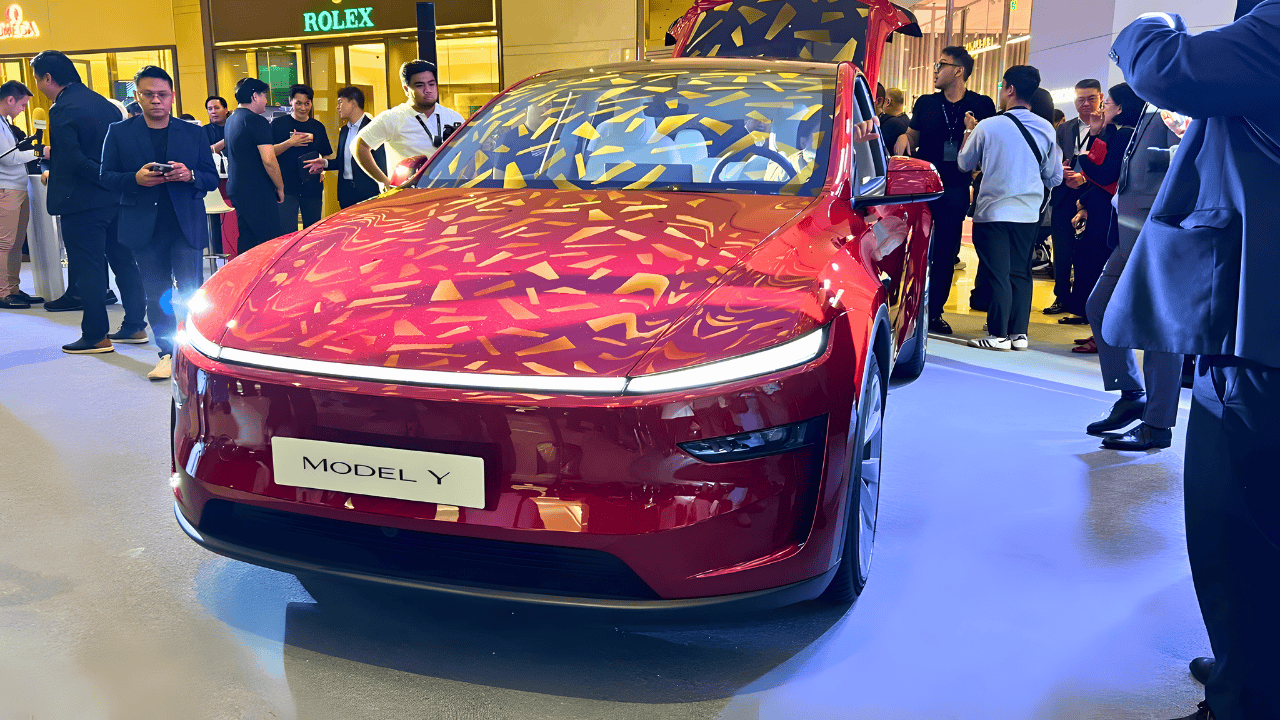

EV Regret Looks Different

Electric vehicles show depreciation rather than immediate resale value. Tesla Model Y owners lost between $22,000 and $27,000 over a two-year period. Nissan Leaf buyers faced 66% first-year depreciation. Technology evolves too fast. Early adopters pay the penalty. Even when vehicles perform well, value collapses. That silent loss fuels frustration without immediate resale.

What Buyers Should Learn

Luxury ownership demands brutal honesty. Total costs matter more than monthly payments. Research reliability carefully. Expect depreciation. Certified pre-owned often offers safer value. EV buyers should consider waiting for infrastructure and technology maturity. The 28.3% resale rate of the Discovery Sport represents real financial stress. Learning from these outcomes can prevent repeating them.

The Final Takeaway

The data exposes an uncomfortable truth. Prestige and value are no longer aligned. Buyers confident in 2025 were selling by 2026. iSeeCars analysis of 18.5 million sales shows luxury first year resale rates reaching 28% versus a 3.6% average. Maintenance costs, depreciation, and reliability concerns drive regret. Dream cars are becoming financial lessons. Research deeply before committing.

Sources:

The Top 10 New Cars Owners Resell in the First Year, iSeeCars.com, October 2025

Luxury Cars Top The List Of New Vehicles Resold Within A Year, CBT News, October 2025

I Sold My Tesla Model Y After One Year, and I Offer This Advice to New Buyers, TorqueNews, July 2025

Tesla Owner Regrets Thinking His EV Was An ‘Investment’, Yahoo Finance, December 2025

Nissan Leaf Has Terrible Resale Value, Money Digest, November 2025

BMW, Luxury Models Top Bargain List Of High Depreciating Used Cars After 3 Years, AutoRemarketing, September 2024