iRobot’s Roomba empire, once a symbol of American ingenuity, has crumbled under $264 million in debt, filing for Chapter 11 bankruptcy on December 14, 2025, in Delaware. With just 274 employees left at its Bedford, Massachusetts headquarters, the company that popularized home robotics now faces absorption by its Chinese manufacturing partner, Shenzhen Picea Robotics, ending 35 years of independence as its NASDAQ ticker IRBT vanishes.

A Pioneer’s Fall

The saucer-shaped Roomba transformed household cleaning when iRobot launched it, building a $3.56 billion valuation during the 2021 pandemic surge. Revenue peaked at nearly $1.6 billion that year but plunged to $682 million in 2024, with a further 25% drop in Q3 2025. Assets and liabilities balanced at $480 million each by late September, leaving cash reserves at a precarious $24.8 million—insufficient for global operations.

The Restructuring Path

This pre-packaged Chapter 11 plan hands 100% equity to Picea, converting iRobot into a private subsidiary. Picea forgives the crippling debt, committing to pay vendors and the skeleton crew of 274 staff during court oversight. Finalization is targeted for February 2026, pending judicial approval and standard conditions, preserving day-to-day functions without immediate shutdowns.

Debt and Creditor Pressures

Core liabilities total $264 million, dominated by a $190 million Carlyle Group loan from 2023 at over 14% interest, plus $74 million owed directly to Picea for manufacturing. Other claims include $2.7 million to BYD Electric Vehicle Company and $34 million to U.S. Customs and Border Protection for unpaid tariffs. These obligations exposed vulnerabilities across the supply chain, from Asia-based production in Vietnam and China to domestic logistics.

Market and External Challenges

Competition eroded iRobot’s lead as rivals like Roborock, Ecovacs, and SharkNinja introduced cheaper models with superior LiDAR navigation, outpacing Roomba’s camera-based systems. U.S. tariffs exacerbated woes: a 46% levy on Vietnamese imports added $23 million to 2025 costs. Workforce shrank from over 1,200 three years ago, mirroring operational cuts amid sales declines.

The Amazon Turning Point

A failed $1.7 billion Amazon acquisition, announced in 2022, accelerated the downfall. Regulators in Europe and the U.S. blocked it over monopoly fears, including data misuse and favoritism toward Amazon devices. Termination in January 2024 brought a $94 million fee, but it failed to stem losses. To bridge the gap, iRobot secured toxic Carlyle financing with stringent covenants it couldn’t meet as markets tightened.

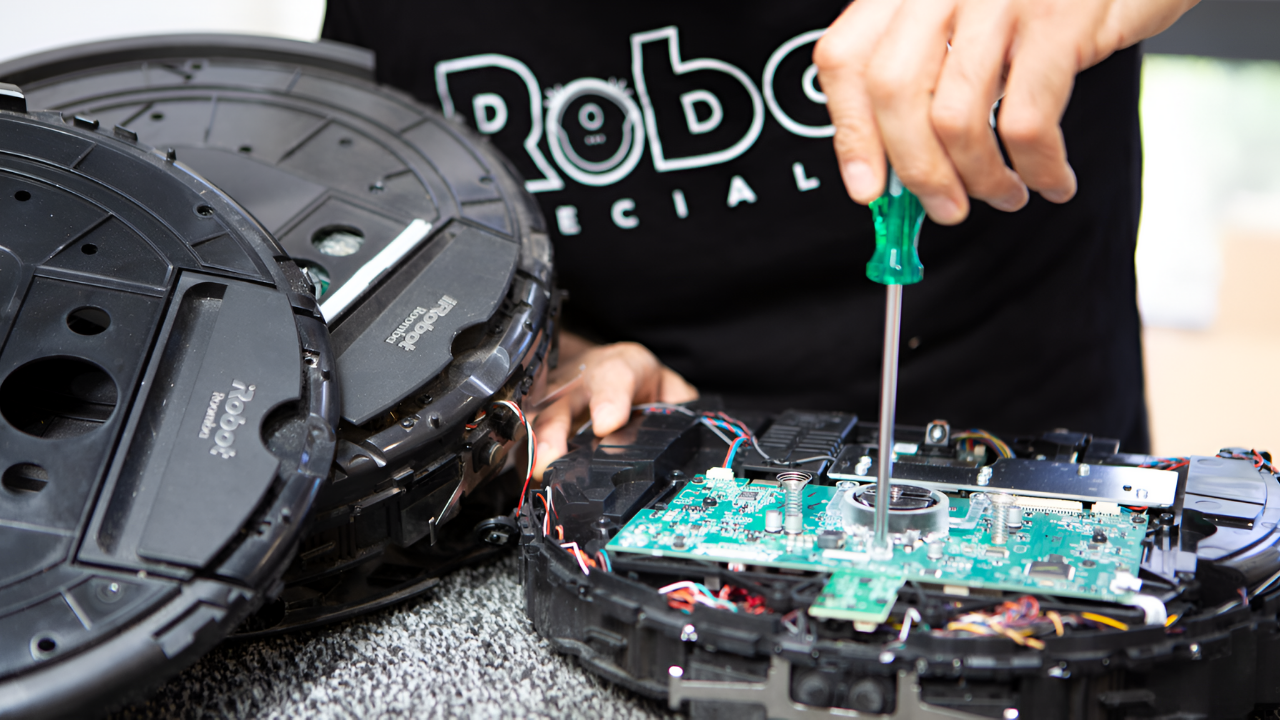

Ongoing Operations and IP Shift

Customers face no disruptions: support, apps, and warranties persist. Picea, having produced millions of units, knows the lineup intimately. The deal transfers over 1,000 patents on navigation, sensors, and algorithms—pivotal American innovations now under Chinese control. New CEO Gary Cohen, installed mid-2024, views it as essential for stability, blending iRobot’s design legacy with Picea’s efficiency. Founder Colin Angle, who left post-Amazon fallout, lamented the loss for U.S. innovation.

This handover safeguards short-term viability but reshapes the robotics landscape, shifting development toward Asia and challenging American dominance amid debt, rivalry, and policy hurdles. Roomba endures, yet iRobot’s standalone era closes, underscoring vulnerabilities in global tech supply chains.

Sources:

“Roomba maker iRobot files for bankruptcy, pursues sale to Chinese manufacturer.” Reuters, 15 Dec 2025.

“iRobot filed for bankruptcy: How the Roomba maker got here.” Business Insider, 16 Dec 2025.

“iRobot enters Chapter 11; Lender to acquire Roomba maker.” Yahoo Finance, 15 Dec 2025.

“Chapter 11 Petition: iRobot Corporation.” United States Bankruptcy Court District of Delaware, 14 Dec 2025.