The number flashed first: $19.5 billion. On December 15, 2025, Ford disclosed one of the largest single charges in its modern history, tied almost entirely to its electric-vehicle ambitions. Charts showed the EV business erased in one stroke—far larger than the unit’s $3.6 billion loss through Q3.

The announcement landed as gas-powered trucks delivered record profits. The contrast was stark, immediate, and impossible to ignore.

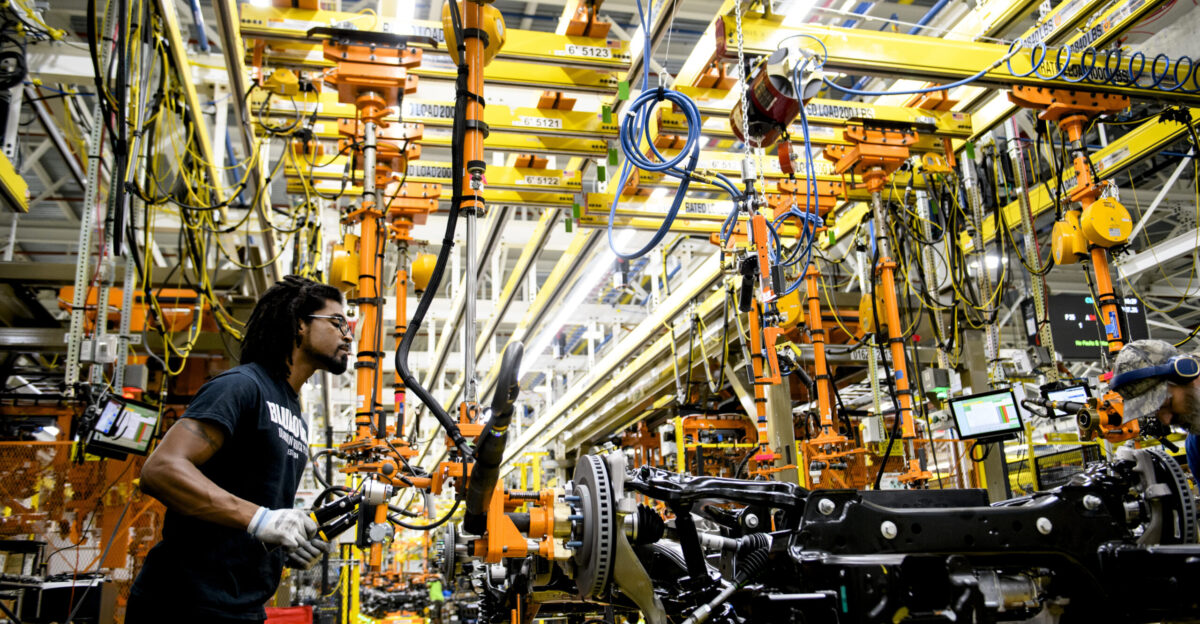

EV Production Goes Dark

Inside Ford’s Dearborn Rouge Electric Vehicle Center, the F-150 Lightning line has been idle since October 2025, though the operational halt remained unannounced publicly until December 15. Robotic arms stand still, workstations empty. A supplier fire disrupted aluminum supply, triggering a halt initially described as temporary.

By December, the pause became indefinite, and Ford formally announced the shutdown during its earnings call—shocking markets and stakeholders with the abrupt public revelation. The shutdown reflects a pivot away hinting at deeper structural trouble in Ford’s EV truck strategy.

The Truck That Built Ford

The F-Series has dominated U.S. truck sales for 48 consecutive years, anchoring Ford’s profits decade after decade. Gas-powered models remain the backbone of the company’s earnings. The electric F-150 Lightning, launched in 2022, was meant to extend that legacy into a new era.

While it became the best-selling electric pickup in Q3 2025, broader EV investments failed to deliver sustainable returns.

Policy Winds Reverse

Demand weakened as government support faded. The $7,500 federal EV tax credit expired September 30, 2025, triggering a short-term buying surge but exposing fragile underlying demand. Soon after, the Trump administration rolled back Biden-era emissions rules and EV incentives.

Lower fuel prices compounded the pressure. Together, policy and market forces undercut the economics of electric trucks just as Ford’s investments peaked.

The $19.5B Write-Down Explained

Ford confirmed the $19.5 billion charge on December 15, 2025, largely booked in Q4. The write-down reflects impaired EV investments, including facilities and production plans tied to the Lightning.

Despite the loss, Ford raised its 2025 operating profit outlook to $7 billion, excluding the charge—powered by gas trucks and SUVs. The message was clear: profitability now lives outside the EV division.

Michigan Workers Reassigned

Roughly 1,200 workers at the Rouge Electric Vehicle Center face involuntary reassignment following the Lightning halt, with some positions eliminated in the EV division. Ford is moving remaining employees to gas and hybrid F-Series lines as production ramps elsewhere in the complex.

At the same time, Ford plans to add 900–1,000 jobs to support expanded gas F-150 and Super Duty output. The jobs remain—but the work has changed.

Owners Left in Limbo

F-150 Lightning owners now face uncertainty. With production paused indefinitely, concerns about long-term support, resale values, and parts availability are growing. Many buyers rushed purchases in Q3 to beat the tax credit deadline.

That surge drove total Ford EV sales to 30,600 vehicles in Q3 (nearly 6% of U.S. sales), with the F-150 Lightning accounting for approximately 10,000 units. This demand surge is unlikely to repeat. Dealers hold inventory as pricing pressure rises and clarity remains scarce.

Rivals Smell Opportunity

As Ford steps back, competitors move in. Tesla’s Cybertruck and Rivian’s R1T aim to capture displaced demand, while GM continues its EV truck rollout. Supplier fires at Novelis aluminum plants in September and November 2025 worsened shortages.

The shortages hit EV-heavy builds hardest. Meanwhile, relaxed emissions rules favor gasoline vehicles. The competitive landscape now tilts away from electric pickups.

The Q3 Spike That Didn’t Last

Ford’s EV unit, Model e, lost $1.4 billion in Q3 2025, bringing year-to-date losses to $3.6 billion. Total Ford EV sales jumped to 30,600 vehicles in Q3 (nearly 6% of U.S. sales), with the F-150 Lightning accounting for approximately 10,000 units, driven almost entirely by tax-credit timing.

Once incentives expired, demand dropped sharply. In contrast, gas-powered F-150s continued driving growth in Ford Blue, reinforcing a clear pattern.

Batteries Find a New Job

Rather than abandon EV assets entirely, Ford is redirecting battery capacity toward energy storage, data centers, and grid infrastructure. The company plans to invest $2 billion to reach 20 gigawatt-hours of storage capacity by 2027.

This pivot reframes part of the $19.5 billion charge as redeployment, not destruction, as Ford seeks returns outside vehicle manufacturing.

Worker Anxiety Grows

Union leaders and workers express concern as EV jobs give way to gas and hybrid production. While reassignment preserves some employment, it underscores how quickly strategy shifts can reshape careers and eliminate positions.

Training programs are expanding, but uncertainty lingers. The Lightning halt became a symbol of volatility shaped by politics, supply shocks, and changing consumer demand.

Ford’s Strategic Reset

Executives are doubling down on what works. Ford plans to boost gas and hybrid F-150 output by 45,000–50,000 units in 2026, backed by a $60 million investment at Dearborn Rouge.

Ford Blue and Pro divisions now take priority over Model e. Capital and talent are being reallocated toward consistent profits, marking a decisive shift in corporate focus.

A 700-Mile Promise

Ford is not abandoning electric trucks forever. The company has teased a next-generation F-150 Lightning EREV, combining electric drive with onboard generation for a 700+ mile range and improved towing.

Current Lightning production ends in 2025, with the next version slated to return to Dearborn. No timeline has been confirmed, leaving anticipation—and skepticism—side by side.

Analysts Remain Skeptical

Market watchers question whether Lightning production will resume anytime soon. Supplier fire losses, continued EV unprofitability, and shifting policy priorities weigh heavily.

Reports suggest Ford may delay or scale back its next-gen rollout. With low fuel prices and relaxed regulations favoring gas trucks, analysts see little urgency for a rapid EV comeback.

A Turning Point for Electric Trucks

Ford now stands between two futures: $7 billion in gas-powered profits and a $19.5 billion EV reckoning. Batteries are powering data centers, not trucks. Workers are building gas F-150s, not Lightnings.

Yet a 700-mile electric pickup still looms on the horizon. Whether it revives Ford’s EV ambitions—or marks a final experiment—remains unanswered.

Sources:

Fortune Magazine | Ford takes $19.5 billion hit, scraps some EV ambitions in pivot to gas and hybrid vehicles | December 15, 2025

Utility Dive | SK On pivots to stationary energy storage after Ford joint venture ends | December 15, 2025

Electric Vehicles.com | Ford’s EV Unit Posts $1.4B Loss in Q3, 2025 Total Surpasses $3.5B | October 24, 2025

Ford Official | Ford Third Quarter U.S. Sales Rise 8.2% | September 30, 2025