The decades-long delivery partnership between Amazon and the U.S. Postal Service is approaching a breaking point. Set to expire next year in October, the contract represents more than $6 billion annually and underpins parcel delivery across the country.

After negotiations collapsed, both sides are quietly preparing for a future apart. The fallout would extend far beyond two organizations, reshaping the parcel market, rural delivery access, and the financial stability of a government-backed institution already under strain. Here’s what’s happening and why the stakes are so high.

What Each Side Stands To Lose

For USPS, Amazon is both a critical revenue source and a growing vulnerability. The postal service collects more than $6 billion annually from Amazon, roughly 7.5% of total operating revenue, according to December 2025 reports. In 2024, Amazon shipments accounted for an estimated 6.3 billion parcels, while USPS delivered about 6.9 billion parcels overall, based on Pitney Bowes data.

That dependence comes at a dangerous moment. USPS reported a $9 billion net loss in fiscal year 2025, according to its November 2025 financial results. First-class mail volume has fallen about 80% since 1997, stripping away what was once its core profit engine. At the same time, the agency carries $188 billion in unfunded pension and retiree healthcare obligations, according to USPS strategic planning documents.

Amazon, by contrast, holds leverage. It delivered 6.3 billion packages in 2024, surpassing FedEx and UPS combined, and controlled roughly 28% of all U.S. parcel volume that year. That scale gives Amazon options USPS simply does not have.

How Negotiations Reached A Dead End

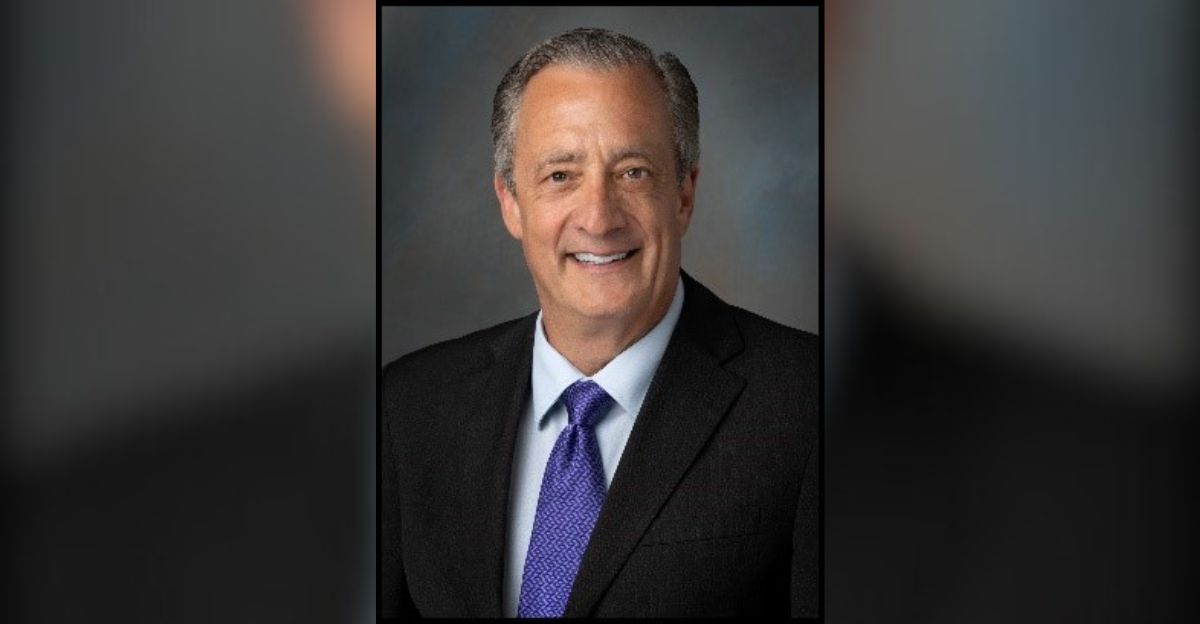

The relationship shifted sharply after David Steiner became Postmaster General and pushed to change how USPS works with major shippers. Instead of renewing Amazon’s long-standing agreement, Steiner backed a reverse auction that would force Amazon to compete against UPS, FedEx, and regional carriers for access to USPS’s last-mile network, according to Reuters and The Washington Post.

Steiner argued publicly that USPS had undervalued its network by relying too heavily on a few large partners. Amazon saw the move as a break from decades of cooperation. The company entered talks in February this year seeking a four-year extension under favorable terms, with negotiations continuing into November.

That month, Steiner informed Amazon that USPS would proceed with an auction rather than a direct renewal, according to sources cited by The Washington Post. By early this month, both sides acknowledged talks had collapsed. The current contract is set to expire October 1, 2026.

Amazon’s Quiet Exit Strategy

Amazon has spent years preparing for reduced reliance on USPS. It already operates more than 25,000 Rivian electric delivery vans nationwide and plans to deploy 100,000 by 2030, according to August reports. In 2024 alone, those vans delivered more than 1 billion U.S. packages, according to Amazon transportation releases.

The company also relies on more than 3,500 Delivery Service Partner businesses employing about 279,000 drivers and delivering over 20 million packages daily, based on October 2023 program announcements. Amazon has invested more than $8 billion in this network since 2018.

In April this year, Amazon announced a $4 billion rural expansion scheduled to finish by late 2026, adding more than 200 delivery stations across roughly 1.2 million square miles, according to CNBC and Reuters. Combined with overflow routed to UPS, FedEx, and regional carriers, Amazon appears capable of absorbing much of the volume now handled by USPS.

A Reroute With No Precedent

If Amazon exits fully after October 1, 2026, approximately 6.3 billion parcels would need to be rerouted. That represents nearly 1 in 3 packages shipped nationwide. Industry analysts say there is no close historical comparison for a logistics shift of this magnitude.

Previous disruptions unfolded gradually. The rise of FedEx and UPS, the 2008 recession, and the COVID-19 shipping surge all reshaped delivery networks over time. None involved one dominant shipper abruptly severing ties with a national carrier at this scale.

Publicly, Amazon has tried to project calm. On December 4, 2025, spokesperson Steve Kelly told The Washington Post and Reuters that the company did not intend to end its relationship with USPS and preferred to continue it. At the same time, he said Amazon was “evaluating all of our options,” signaling active contingency planning.

Why Rural America Faces The Biggest Shock

Rural communities are likely to feel the impact first. Amazon’s expansion covers about 1.2 million square miles, but USPS serves more than 42,000 ZIP codes nationwide, according to official data. In many farming regions, tribal lands, and remote areas, USPS remains the only carrier legally required to deliver six days a week.

Without Amazon revenue, USPS may raise rural parcel prices or cut service levels. In September 2024, the agency implemented rural surcharges ranging from $0.95 to $3.15 for certain ZIP codes, with some Priority Mail rates rising more than 12%, according to shipping rate analysis.

Small and midsize e-commerce sellers could also be squeezed. Higher USPS prices may push them toward Amazon’s fulfillment network, which charges substantial commissions. Inside USPS, lost volume could accelerate workforce reductions. In March, USPS announced plans to cut 10,000 positions through voluntary early retirement programs.

A Delivery System At A Turning Point

The dispute lands amid renewed debate over USPS’s future. Critics continue to question its finances and structure, while Steiner’s auction strategy reflects a push to treat the postal network as a commercial asset rather than protected infrastructure. Amazon, wary of shifting policy and political oversight, has strong incentives to limit dependence on a government-run carrier.

If the partnership ends, USPS faces difficult choices. Those include raising rates, trimming routes, seeking legislative relief, or pursuing structural reforms. Regional carriers and major retailers are poised to expand, potentially leaving a more consolidated delivery landscape behind.

How this standoff resolves will shape who controls the nation’s delivery backbone for years to come. Rural households, small businesses, and everyday consumers are likely to feel the consequences first through higher costs, slower deliveries, or both.

Sources

“U.S. Postal Service Reports Fiscal Year 2025 Results,” U.S. Postal Service Official Newsroom, November 13, 2025

“Amazon in Discussions with USPS About Future Relationship,” Reuters Technology, December 4, 2025

“Amazon Eyes Expanding Delivery Network After Talks with USPS,” Washington Post Business, December 4, 2025

“Postmaster General David Steiner’s Nov. 14, 2025 USPS Board of Governors Meeting Remarks,” U.S. Postal Service Official Newsroom, November 14, 2025

“Amazon to Spend $4 Billion on Small Town Delivery Expansion,” CNBC, April 30, 2025

“How a $6 Billion Breakup Could Rewrite U.S. Last-Mile Delivery,” LinkedIn Analysis, December 6, 2025