A $1,399 iPhone Air now sells for $668. That’s a 47.7% value collapse in ten weeks—the worst depreciation of any iPhone since 2022. By late November, Foxconn had dismantled production lines across Asia. Luxshare Precision shut down entirely. Apple removed the iPhone Air 2 from its calendar with no replacement date.

The product that was supposed to revolutionize smartphone design instead forced Samsung, Xiaomi, Oppo, and Vivo to abandon their ultra-thin flagship projects overnight.

When Apple’s Vision for Ultra-Thin Design Met Reality

Apple unveiled the iPhone Air in September 2025 as the world’s thinnest flagship smartphone, measuring 5.6 millimeters thick and weighing just 165 grams. Precision-milled Grade 5 titanium frame, Ceramic Shield 2 glass, A19 Pro chip, 6.5-inch Super Retina XDR display with 120Hz ProMotion—every specification represented engineering excellence.

Yet within six weeks, Apple’s supply chain revealed what the company’s marketing team had hoped to conceal: consumers didn’t want this phone, regardless of how revolutionary its thinness actually was.

The Supply Chain Confession

By late October 2025, just six weeks after launch, Apple drastically slashed iPhone Air production to less than 10% of September volumes. Sources at Nikkei Asia described manufacturing levels as “near end-of-production,” terminology typically reserved for discontinued devices.

Foxconn is prepared to dismantle nearly all production lines. Luxshare Precision halted manufacturing entirely. Apple’s component suppliers, accustomed to massive orders, suddenly faced canceled allocations, excess inventory, and the grim task of reallocating production capacity they had built specifically for this model.

The Numbers That Told the Real Story

SellCell’s analysis of over 40 U.S. buyback companies delivered the verdict consumers had already rendered. The 1TB iPhone Air dropped from $1,599 to $668 in ten weeks. The 512GB variant lost 45.2% of its value.

Across all configurations, the Air averaged 44.3% depreciation—compared to 34.6% for the standard iPhone 17 and 26.1% for the iPhone 17 Pro Max. The market had spoken with mathematical precision: the iPhone Air was the device nobody wanted to own.

Why Consumers Said No to Ultra-Thin Innovation

To achieve a 5.6 millimeter thickness, Apple made critical compromises. The Air’s battery capacity dropped to 3,149 mAh, below the standard iPhone 17’s 3,692 mAh. It included a single rear camera instead of multiple lenses. The single speaker couldn’t match stereo audio on Pro models.

Yet Apple priced the Air at $999—only $350 less than the iPhone 17 Pro at $1,349, which offered triple cameras, superior battery life, and better audio. Consumers calculated the value equation and rejected it unanimously.

The Most Telling Sign: Available Stock, Empty Shelves Elsewhere

Apple’s retail website clearly painted the picture. The iPhone 17 and iPhone 17 Pro showed shipping delays of two to three weeks following launch. The iPhone Air remained available for immediate shipment across all color options—Space Black, Cloud White, Light Gold, Sky Blue.

This wasn’t a supply constraint; this was a demand collapse. Millions of units manufactured for an anticipated breakthrough product sat ready to ship to customers who simply weren’t buying.

The Warning Apple Ignored

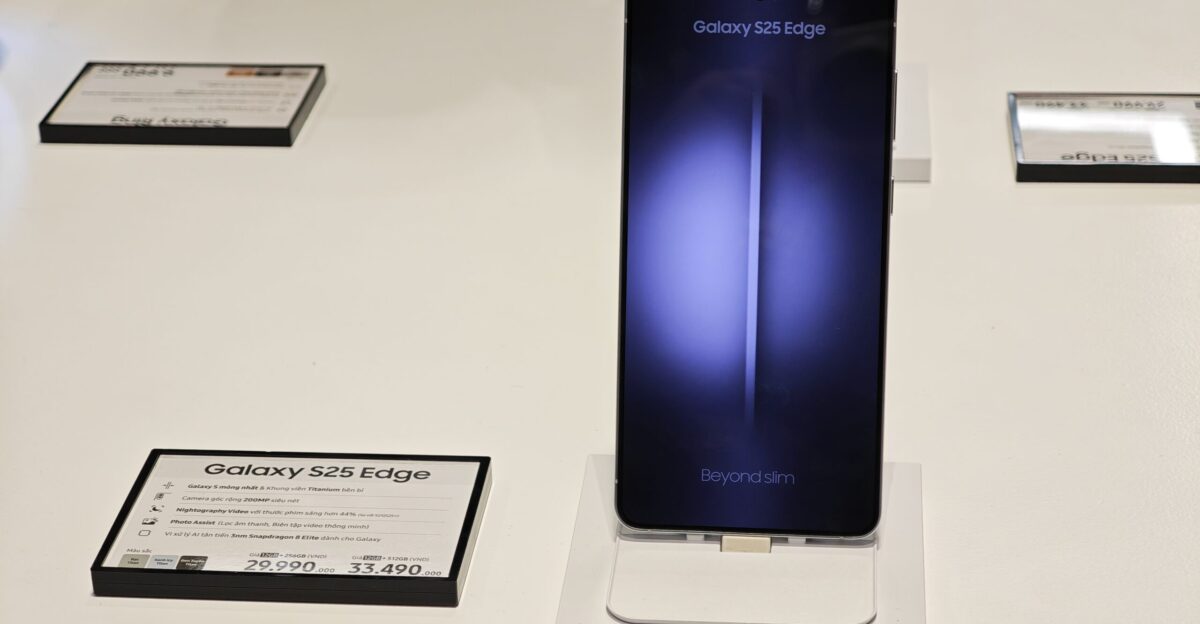

Apple’s collapse didn’t occur in isolation. Samsung’s Galaxy S25 Edge, launched in May 2025 at 5.8 millimeters thick, had already demonstrated market rejection. By August 2025, the Edge sold only 1.31 million units, dwarfed by 8.28 million standard S25 sales, 5.06 million S25 Plus sales, and 12.18 million S25 Ultra sales.

Samsung subsequently halted S25 Edge production and canceled the Galaxy S26 Edge entirely. The market had already spoken—Apple simply didn’t listen.

How One Product Froze an Entire Industry

News of Apple’s failure triggered an unprecedented industry-wide retreat from ultra-thin development. Xiaomi immediately scrapped its planned “true Air model,” engineered specifically to compete with Apple’s device. Oppo and Vivo, which had invested significant resources into ultra-slim flagship projects, froze their initiatives indefinitely.

These weren’t minor design postponements—these were entire product lines being shelved because Apple’s failure proved the market didn’t exist. Within days of production shutdown announcements, competitors had made their decisions.

The Supply Chain Casualties

Component suppliers faced immediate financial impact. Precision-milled titanium frame manufacturers who had geared up for high-volume iPhone Air production suddenly received cancellation notices. Suppliers of specialized camera modules, ultra-thin display panels, and custom chips found themselves with excess inventory and reduced headcount.

Foxconn and Luxshare, which had reorganized manufacturing capacity specifically for the Air, faced significant operational restructuring and workforce adjustments across multiple Asian facilities.

Apple’s Indefinite Delay: The Product in Limbo

In November 2025, Apple delivered the final blow to the ultra-thin initiative: the iPhone Air 2, originally scheduled for fall 2026 alongside the iPhone 18 lineup, was removed from the development calendar indefinitely. Engineering teams received notification that while the Air 2 hadn’t been formally canceled, no production timeline existed.

Some engineers remained assigned to the project, suggesting potential consideration in 2027, but without confirmed schedules. A product conceived as Apple’s fourth flagship pillar had become an industry pariah in four months.

What Market Research Actually Revealed

KeyBanc Capital Markets’ consumer survey showed “virtually no demand” for the iPhone Air outside China, with consumers expressing “very limited willingness” to pay premium prices for ultra-thin devices.

IDC and Counterpoint Research confirmed conversion rates approximately 33% lower than other iPhone 17 models, despite generating over one million product page views in September. Consumers clicked, researched, compared—and then chose the Pro model instead.

The Irony: iPhone 17 Pro Models Flourished

While the Air collapsed, the iPhone 17 Pro achieved unprecedented demand. Both standard and Pro variants experienced two to three week shipping delays following launch. Apple’s Q4 2025 guidance explicitly excluded the iPhone Air from positive forecasts, a tacit admission that the device had become a drag on the portfolio.

The company was on track for record holiday quarter sales—but only because customers were buying Pro models, not the Air.

Industry Consensus: Design Innovation Doesn’t Trump Functionality

The iPhone Air saga revealed a critical market principle at premium price points. Consumers accept incremental thickness increases when accompanied by meaningful enhancements in capability.

They reject flagship prices for devices, sacrificing core functionality—such as battery life and camera quality—for marginal thickness reductions, when competing products offer superior performance at similar prices. Premium buyers prioritize performance over aesthetics.

The Pivot: Foldables Over Ultra-Thin Conventional Phones

The smartphone industry is consolidating around foldable technology, rather than ultra-thin conventional designs. Samsung is redirecting resources toward the development of the Galaxy Z Fold and Z Flip.

Apple is reportedly using the iPhone Air as a technology testbed for future foldable devices, including custom chip integration and specialized display systems. The ultra-thin conventional smartphone has become an evolutionary dead-end.

The Lasting Legacy

The iPhone Air stands as remarkable engineering that solved a problem nobody asked Apple to solve. At 5.6 millimeters, it proved that premium materials and design innovation could achieve thinness at scale.

Commercially and strategically, it remains a cautionary tale: superior engineering alone cannot create demand for products fundamentally misaligned with consumer values. In crushing the ultra-thin smartphone industry, the iPhone Air ultimately revealed the limits of design-first innovation in a market that prioritizes performance-first practicality.

Sources:

SellCell resale value analysis (December 2025); MacRumors iPhone Air depreciation report;

9to5Mac iPhone Air production cuts; Nikkei Asia supply chain reporting;

KeyBanc Capital Markets consumer survey;

IDC and Counterpoint Research conversion rate analysis; India Today Xiaomi/Oppo/Vivo ultra-thin cancellation reporting