After 18 months of intense scrutiny, TikTok’s 170 million U.S. users gained stability as ByteDance finalized binding agreements to transfer operational control of its American business to a U.S.-led consortium. Valued at $14 billion, the TikTok U.S. Data Security joint venture promises enhanced data safeguards and continued access, but lingering ties to Beijing raise doubts about the depth of the shift.

What Sparked the National Security Alarm

Fears ignited over ByteDance potentially sharing U.S. user data with Chinese authorities or altering content feeds for one of America’s most popular apps. Early warnings from officials like Secretary Mike Pompeo and President Donald Trump labeled TikTok a security threat, citing instances of ByteDance staff accessing American data from China. These revelations prompted initial ban discussions and set Congress on a path to intervention, amid broader concerns about foreign influence in digital spaces.

The Legislation That Drew the Line

Bipartisan momentum culminated in April 2024 with the Protecting Americans from Foreign Adversary Controlled Applications Act, or PAFACA. Signed by President Joe Biden, it demanded ByteDance divest its U.S. operations or face a ban by January 19, 2025. App stores risked civil penalties up to $850 billion for noncompliance. This measure singled out TikTok as the first app-specific foreign ownership mandate, though its execution revealed layers of legal and political complexity.

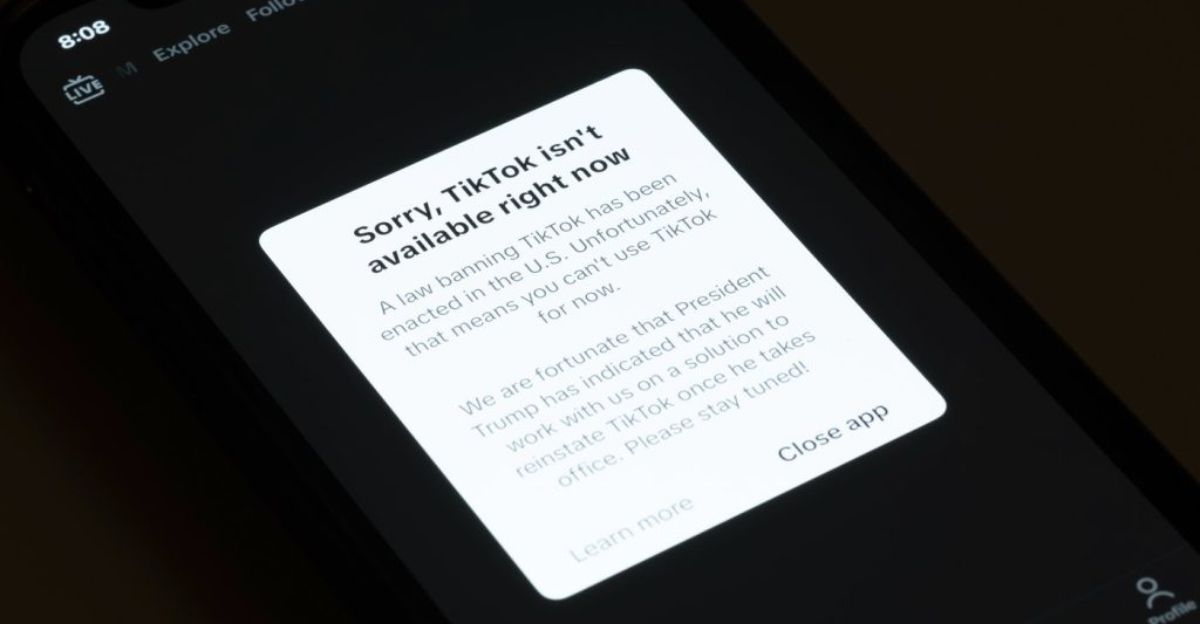

The Day the App Vanished—and Returned

Tension peaked on January 18, 2025, when TikTok vanished from U.S. app stores after ByteDance missed the deadline. Apple and Google complied, stranding millions overnight. Relief came swiftly: by January 19, the app reappeared with a message thanking former President Trump. He granted a 75-day enforcement delay, marking a pivotal intervention that stunned observers and reshaped the timeline.

Trump’s Shift and the Deal’s Key Players

Trump, who pushed for a ban in 2020, pivoted by 2024, arguing a prohibition would bolster rivals like Facebook. After reclaiming the presidency, he suspended PAFACA enforcement, waived penalties for providers, and championed TikTok’s appeal to young users—while imposing conditions for oversight. Oracle co-founder Larry Ellison, worth over $180 billion and a Trump ally, stepped forward. Oracle secured roles as cloud host, data overseer, and algorithm manager, evolving from supplier to enforcer of U.S. security standards.

The deal vests Oracle, private equity firm Silver Lake—which oversees $75 billion—and Abu Dhabi’s MGX, each with 15% ownership in the joint venture, totaling 45% control. A seven-member board features six Americans and one ByteDance seat, tilting governance toward the U.S. ByteDance surrendered day-to-day operations but holds majority shares in high-revenue segments like TikTok Shop, which reached $5.8 billion in U.S. gross merchandise value in the first half of this year, and advertising. Critics highlight how this preserves Beijing’s financial foothold amid data and content handoffs.

Algorithm Overhaul, Data Safeguards, and Global Implications

Central to the agreement: retraining TikTok’s core recommendation algorithm solely on U.S. data, hosted on Oracle’s domestic servers. This prized technology, once fed global inputs, now faces constant monitoring for external meddling. Oracle audits user patterns, flags anomalies, and enforces privacy, addressing core fears of manipulation. Yet ByteDance’s business interests prompt questions about enforcement rigor in this hybrid setup.

The arrangement blends security wins with economic realities, influenced by Ellison’s networks and Trump’s realignment. Tech analysts offer divided views: some praise Oracle’s role as pragmatic protection; others decry ByteDance’s revenue grip as a loophole. Supreme Court precedents on executive limits shaped compromises, while ByteDance eyes global AI and e-commerce growth. Similar scrutiny grips the UK, EU, India, and Australia, positioning the U.S. model as a potential blueprint. For users, stability means feature expansions and e-commerce pushes, but sustained transparency from all parties will test trust amid U.S.-China tech frictions. The balance of innovation, profit, and oversight will define TikTok’s trajectory and future foreign app regulations.

Sources:

Protecting Americans from Foreign Adversary Controlled Applications Act. U.S. Congress, April 2024

Official Executive Orders on TikTok Regulation. U.S. Government, January 2025

Financial Disclosure on TikTok USDS Joint Venture. Oracle Corporation, 2025

TikTok User Data Security Reports. U.S. Federal Agencies, 2023

Political Impact Analysis on TikTok Ban. Reuters, 2025