In December 2025, a Dutch automotive leasing company that had staked its entire existence on a single entrepreneur’s vision faced complete financial ruin. Mistergreen, which built a fleet of over 4,000 Tesla vehicles worth roughly $200 million, is now bankrupt with bondholders wiped out and investors facing tens of millions in losses. The company’s downfall reveals a cautionary tale about blindly trusting corporate promises while ignoring fundamental economic reality.

It also raises uncomfortable questions about whether other major companies are making similar miscalculations right now, starting with how Mistergreen made its first big bet.

A Tesla-Only Bet That Changed Everything

Mistergreen started as a Dutch leasing pioneer, focusing exclusively on Tesla vehicles in the Netherlands. Founded around 2019, the company positioned itself as a leader in sustainable mobility by betting Tesla would dominate the EV future. Unlike traditional rental firms that diversify, Mistergreen wagered its entire operation on 1 brand. The logic sounded persuasive at the time, until a single promise took over.

The Promise That Started Everything

In July 2019, Elon Musk made a statement that echoed through leasing: “I think the most profound thing is that if you buy a Tesla today, I believe you are buying an appreciating asset-not a depreciating asset,” tied to Full Self-Driving and robotaxis. Musk suggested a $50,000 Model 3 could be worth $100,000 to $200,000. Mistergreen’s leadership believed him, and built everything around that idea.

How Mistergreen Built Its Fortress

By 2022, Mistergreen had accumulated a fleet exceeding 4,000 Tesla vehicles and expanded aggressively. It financed the push through bond issuances, borrowing roughly $150 million from investors plus interest. Its 2022 annual report cited Tesla self-driving readiness and charging advantages for residual value stability. The entire model hinged on 1 assumption, but markets rarely honor assumptions forever.

Tesla Cuts Prices by 30%: The Collapse Begins

In 2023, Tesla launched aggressive price cuts to defend market share against rising Chinese EV competition. Prices fell roughly 30% on core models, instantly crushing used values. For leasing fleets holding thousands of Teslas, buyers could simply purchase new cars cheaper. Mistergreen’s $200 million asset base began losing value rapidly. Suddenly, bond math and depreciation no longer matched reality.

Hertz’s Parallel Disaster: A $4.2 Billion Lesson

In October 2021, Hertz made an even bolder bet, announcing it would buy 100,000 Teslas worth roughly $4.2 billion. CEO Mark Fields said: “Electric vehicles are now mainstream, and we’ve only just begun to see rising global demand and interest,” according to reporting from Oct 28, 2021. Hertz touted EV leadership, but by 2024 the decision drove nearly $3 billion in losses.

The Numbers That Shocked Everyone

Hertz’s full-year 2024 results revealed the scale: a $2.9 billion net loss, according to results reported Feb 6 2025. It booked a $245 million write-down in Q4 2023, then $175 million more in 2024, plus $48 million losses on EV sales. EV repair costs added $646 million in 2023. The robotaxi story looked less like innovation and more like liability.

Musk’s Robotaxi Timeline: Broken Promises

Musk’s autonomous timeline showed a damaging pattern. In October 2019, he promised “over a million robotaxis on the road” by 2020, activated by software update. That deadline passed with 0 robotaxis. Then 2021, 2022, 2023 deadlines came and went. By mid-2025, he told investors service would cover “half the U.S. population” by year-end 2025, but reality lagged sharply.

The Reality of Full Self-Driving

Tesla’s Full Self-Driving remained classified as SAE Level 2 assistance, requiring constant driver attention. Level 5 autonomy, what Musk implied, means 0 human intervention in any condition. That gap involves perception limits, redundancy, and regulation. Yet Mistergreen built its $200 million strategy expecting fast progress from Level 2 toward robotaxis. The harder the gap proved, the less defensible residual value optimism became.

Austin’s Robotaxi Reality Check

When Tesla launched its Robotaxi service in Austin, Texas in June 2025, observers saw limits. Reports suggested about 5 to 30 vehicles ran at once, and human safety monitors sat in passenger seats. Engineering student analysis found the service unavailable around 60% of the time. Musk claimed 1,000 Robotaxis would operate “within a few months,” but by December 2025 Austin had roughly 30, raising a question of scale.

Musk’s December Claims: “Three Weeks”

In mid-December 2025, Musk claimed at an xAI Hackathon Tesla would remove safety monitors from Robotaxi vehicles “in about three weeks,” saying unsupervised operation was “pretty much solved,” according to Teslarati reporting Dec 2025. He shared video suggesting he rode without a safety monitor, yet paying customers still got monitors. The mismatch between talk and deployment kept persisting, and for fleet owners it changed financial risk.

Why Cameras Alone Weren’t Enough

Tesla chose a camera-only approach, rejecting radar and lidar used by rivals like Waymo. Musk publicly argued vision-only avoids “sensor contention.” But leaked private messages from 2021 showed he told engineers high-resolution radar plus cameras would be safer than cameras alone, while still rejecting sensor fusion publicly. For outsiders, that contradiction chipped away at confidence in Tesla’s autonomy narrative, just as depreciation pressures were intensifying.

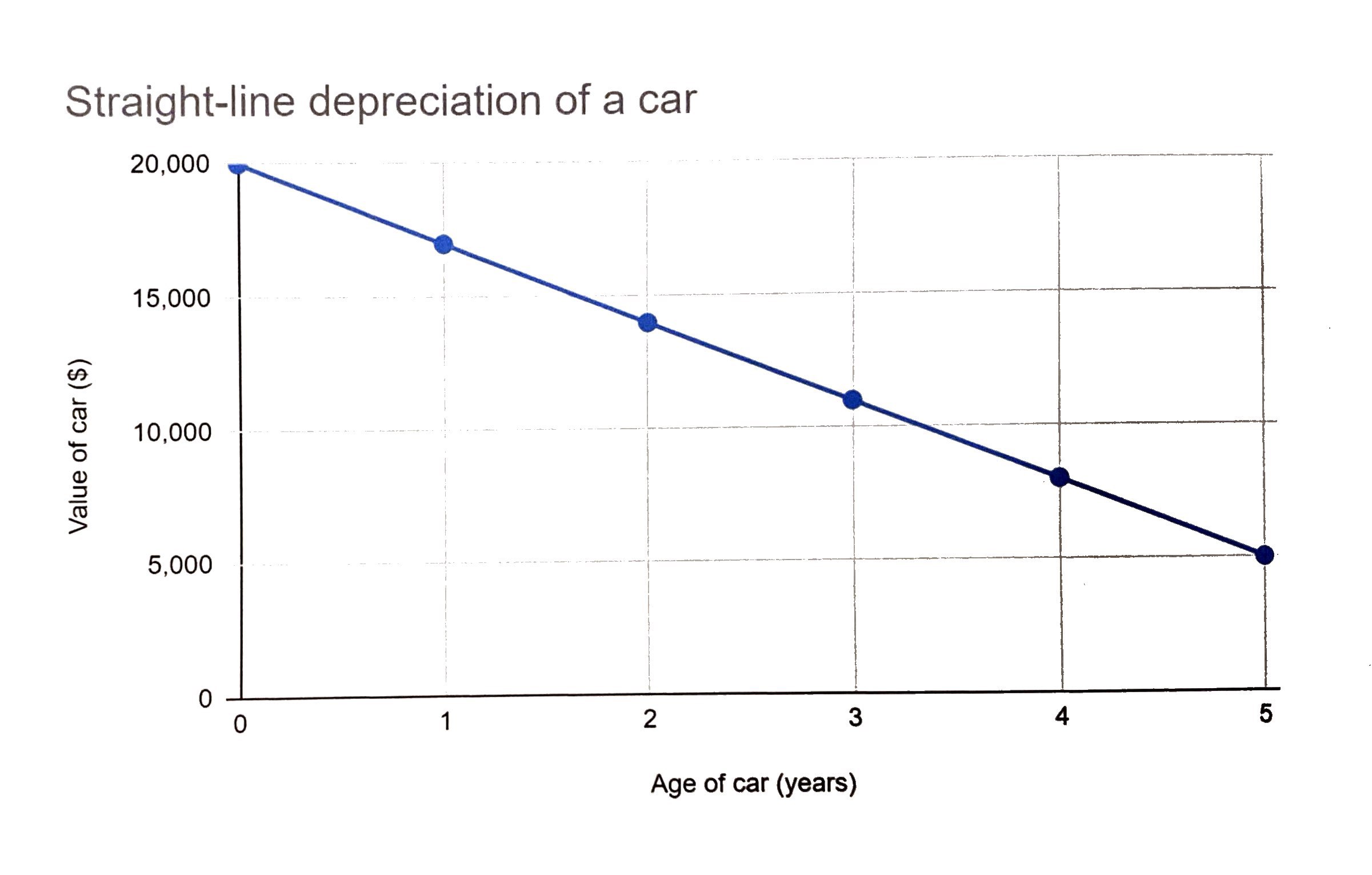

Depreciation Data Tells The True Story

Depreciation data undercut the appreciating-asset thesis. A Tesla Model 3 bought new for roughly $51,000 in 2025 would drop to $35,945 after 1 year, $28,680 after 2 years, and $20,136 after 5 years, a 61% total decline, according to CarEdge. A Model Y showed similar 61% 5-year depreciation. Commercial use can worsen this. If values fall that fast, debt structures become traps.

The Bond Trap: Debt Never Shrinks

Mistergreen’s bonds meant roughly $150 million in fixed obligations, plus interest, regardless of used Tesla prices. As vehicle values dropped, liabilities stayed the same. The company faced a brutal mismatch: $150 million+ owed against fleet assets perhaps worth only $100 million to $120 million. Operating profits could not close that gap. By 2024, Mistergreen struggled to service bond payments, and insolvency stopped being theoretical and became procedural.

Others Made The Opposite Bet

Sixt, Europe’s largest car rental company, added Teslas in select fleets in 2022, then changed course. After residual values fell following price cuts, Sixt halted future Tesla purchases in 2024-2025 and worked down existing inventory. It turned toward diversification, leaning more on other brands including BYD. When a major operator openly pulls back, it signals learning from pain, and it invites a closer look at what the biggest lessors were saying internally.

Ayvens Chooses “Margin Over Growth”

Ayvens, created from ALD Automotive and LeasePlan, shifted strategy in 2024-2025. CEO Tim Albertsen said it would prioritize “margin over fleet growth,” signaling retreat from aggressive EV expansion. Ayvens noted EV residual values would “not behave like ICE cars” and predicted EV prices would “decrease over the next 5 to 7 years” as technology improves, citing its PowerUp 2026 strategy documents. That industry reset made Mistergreen’s stance look increasingly isolated.

Arval’s Pivot Away From Tesla

Arval responded by partnering with BYD, the Chinese manufacturer that became the world’s largest EV producer by volume, according to a BYD Lease announcement dated Jan 2 2025. The deal reduced dependence on Tesla and increased exposure to alternative platforms. For fleet operators, the message was blunt: concentration risk plus unpredictable pricing can sink an otherwise modern strategy. That context made the timing of Mistergreen’s final collapse feel less surprising.

December 2025: Bankruptcy Becomes Official

In mid-to-late December 2025, reports said Mistergreen’s bankruptcy was complete. The firm could not keep operating with an insolvent balance sheet and defaulted bond obligations. Its remaining fleet was sold to a consortium of Dutch, Belgian, and German leasing companies that could buy depreciated vehicles at distressed prices. Bondholders faced massive losses estimated at tens of millions of dollars. Even so, the deeper warning extended beyond 1 Dutch company.

The Broader Warning For Corporate Promises

Mistergreen and Hertz show what happens when firms commit huge capital based on leadership promises. Musk’s 2019 “appreciating assets” line became a foundation for real business decisions, not just hype. Repeated robotaxi deadline misses from 2020 – 2025 created predictable financial damage for companies relying on those claims. How many other industries are betting on breakthrough timelines that will slip the same way?

The Unresolved Question: Who Is Accountable?

Mistergreen’s collapse raises unresolved accountability questions. Musk overstated autonomy timelines by about 4 to 6 years between 2019-2020 claims and 2025 reality, yet few mechanisms punish inaccurate predictions that cause third-party losses. Leasing companies and Hertz made decisions assuming credible corporate claims that did not materialize. Whether regulators, investors, or courts should demand stronger proof before billion-dollar reliance remains unclear, and that uncertainty shapes what companies do next.

What Comes Next After Spectacular Failure

The industry is adapting after Mistergreen and Hertz. EV adoption still matters for climate and regulation, but lessors are tightening residual value assumptions, seeking buyback agreements to shift risk, and diversifying across manufacturers rather than depending on 1 brand.

Autonomous driving may arrive, but likely years later than Musk suggested. The transition will be more economically disruptive than expected, and today’s boldest bets are already being re-priced quietly.

Sources

Tesla rental fleet that bought into Elon Musk’s self-driving lies goes bankrupt due to depreciation. Electrek, Dec 19 2025

Hertz full-year 2024 results. Hertz, Feb 6 2025

Tesla launched Robotaxi service in Austin. Reuters, Jun 2025

CarEdge Tesla depreciation data for Model 3 and Model Y. CarEdge, 2025

Ayvens PowerUp 2026 strategy documents. Ayvens, 2024-2025