Cracker Barrel Old Country Store, the 56-year-old Tennessee-based family-dining chain, is facing one of the most difficult periods in its history. Operating roughly 660 locations nationwide, the company posted a steep loss in the first quarter of fiscal 2025 as traffic declined sharply.

A controversial brand refresh, weakening consumer demand, and rising cost pressures collided at once, exposing vulnerabilities in a business long viewed as a stable roadside staple.

How a Logo Sparked Wider Issues

The crisis intensified after Cracker Barrel introduced a new logo in mid-2024 as part of a modernization effort.

The redesign drew swift backlash online, with critics labeling it out of touch with the brand’s traditional image. What began as a visual update quickly escalated into a reputational challenge, as leadership acknowledged that the controversy hurt guest perception and contributed to falling traffic during an already fragile consumer environment.

Diners Pull Back as Trust Erodes

Customer pullback became visible in hard numbers. Same-store sales declined 4.7% in the first quarter, while traffic dropped 7.3%. By late in the following quarter, traffic was running roughly 11% below prior-year levels.

Fewer diners meant emptier dining rooms and weaker retail-store performance, undermining both food and gift-shop revenue streams that traditionally support Cracker Barrel’s roadside business model.

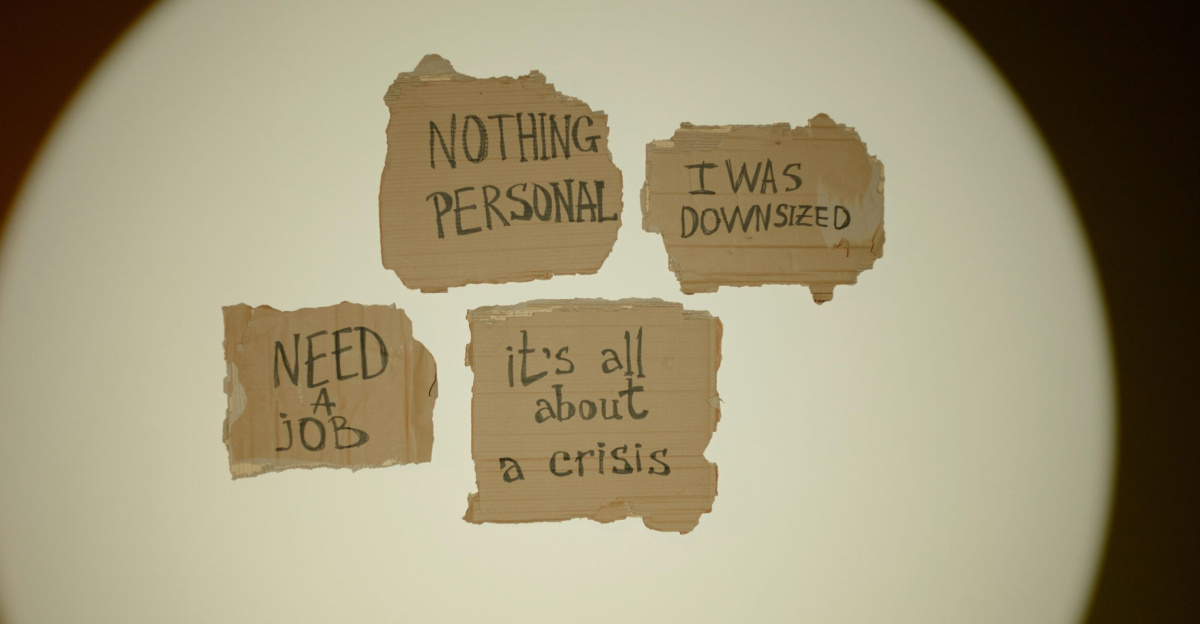

Corporate Cuts Reshape the Company

To stem losses, Cracker Barrel announced two rounds of corporate staff reductions aimed at saving $20 million to $25 million annually. While the cuts primarily affected headquarters roles, they signaled broader pressure across the organization.

Newly appointed CEO Julie Felss Masino and CFO Craig Pommells framed the layoffs as a necessary step to stabilize operations and protect the long-term viability of the company’s nationwide footprint.

Competitors and Substitutes Seize Opportunity

As Cracker Barrel struggles, competitors in the family-dining and casual segments stand to benefit. Travelers seeking familiar, predictable meals have more options than ever, from regional chains to fast-casual alternatives.

With brand confidence shaken, displaced guests may permanently shift loyalty, allowing rivals to capture traffic that once reliably flowed to Cracker Barrel’s highway-adjacent locations.

Supply Chains and Tariffs Add Strain

Operational pressures extend beyond branding. Tariffs on imported retail merchandise have increased costs in Cracker Barrel’s gift shops, where sales fell 8.5% in the quarter.

Management has warned that tariffs will continue to affect margins, forcing supply-chain adjustments and vendor changes. These headwinds further complicate recovery efforts, especially as discretionary retail purchases weaken alongside declining restaurant traffic.

Workers Face Layoffs and Uncertainty

The financial downturn has had a direct human impact. Corporate employees were hit by restructuring, while remaining staff face tighter budgets and heightened performance pressure.

Although restaurant-level layoffs were not broadly announced, uncertainty now hangs over workers across the system. For many employees, the crisis represents a sudden reversal for a company long perceived as a stable employer in small-town America.

Politics Amplify the Backlash

The logo controversy became a national talking point after public criticism from President Donald Trump on social media.

That attention transformed a corporate branding decision into a political flashpoint. The resulting polarization made it harder for leadership to control the narrative, as the rebrand became entangled in broader cultural debates rather than evaluated solely as a business decision.

From One Quarter’s Loss to Wider Signals

Cracker Barrel’s first-quarter net loss of $24.6 million marked a sharp swing from prior profitability. Management responded by cutting its full-year outlook, projecting revenue of $3.2 billion to $3.3 billion and adjusted EBITDA of $70 million to $110 million.

These revisions underscore how brand damage, when combined with cautious consumer spending, can rapidly erode earnings in the restaurant sector.

Guests Reassess Roadside Dining Habits

For generations of travelers, Cracker Barrel symbolized comfort and familiarity. Now, many guests are reassessing where and how they dine on the road.

Despite a loyalty program with more than 10 million members accounting for roughly 40% of sales, declining visits suggest price sensitivity and reputational concerns are outweighing brand nostalgia, even among long-time customers.

Reputation, Ratings, and “Woke” Debates

The crisis presents a paradox. Customer ratings and in-store satisfaction remain relatively strong, reaching levels not seen since before the pandemic.

Yet online discourse surrounding the logo fueled accusations of “woke” branding, alienating part of the core audience. This disconnect between operational performance and public perception highlights how digital narratives can overpower real-world experiences.

A Lesson in Consumer Perception

Cracker Barrel’s experience illustrates how branding decisions can intersect with cultural identity. The rebrand was intended to modernize a heritage image but instead exposed the risks of misjudging customer sentiment.

The episode underscores the importance of testing changes carefully, understanding core demographics, and anticipating how social media amplification can quickly reshape brand meaning.

Winners, Losers, and Shifting Loyalty

While Cracker Barrel absorbs losses, others may gain. Independent diners, regional chains, and fast-casual concepts could attract guests seeking alternatives.

Still, Cracker Barrel’s scale—660 locations and a massive loyalty base—gives it leverage many competitors lack. Whether that advantage translates into recovery depends on how effectively management repairs trust and restores traffic.

What Customers and Investors Can Do Now

Customers weighing dining options may compare prices, menus, and promotions more carefully as budgets tighten.

Investors, meanwhile, are watching traffic trends, margin recovery, and management’s brand-repair strategy. With guidance lowered and volatility elevated, cautious positioning and diversification remain key as the company works through what leadership describes as a prolonged rebuilding phase.

Can Cracker Barrel Rebuild Its Brand?

CEO Julie Masino has acknowledged that the company faces a brand reputation problem that will not be fixed overnight. Rebuilding trust “one guest at a time” will require consistent execution, clearer messaging, and patience.

Future quarters will reveal whether cost cuts, operational discipline, and recalibrated marketing can restore confidence—or whether the damage marks a lasting shift for an American icon.

Sources:

- Cracker Barrel Old Country Store, Inc. Q1 FY2025 Earnings Release — Cracker Barrel Investor Relations (November 2024)

- Cracker Barrel Old Country Store, Inc. Q1 FY2025 Earnings Conference Call Transcript — Cracker Barrel Investor Relations (November 2024)

- Cracker Barrel shares tumble after sales miss, outlook cut — MSN (syndicated business/finance report, late 2024)

- Cracker Barrel warns of tariff impact on retail segment — Fox Business (2025)

- Cracker Barrel (CBRL) DCF Valuation and Financial Analysis — DCFModeling (2024–2025)