In 1958, Ford launched a vehicle they thought would revolutionize the market. Instead, it became an unforgettable disaster. The Edsel, with its controversial design, didn’t just fail to impress—it became a cautionary tale of corporate hubris.

From monumental design mistakes to missed market signals, the cars in this list didn’t just struggle; they nearly bankrupted their manufacturers. From Ford’s Edsel to the Pontiac Aztek, these automotive disasters highlight the risks of bold innovation gone catastrophically wrong.

Ford Edsel

Ford invested enormous resources into the Edsel, projecting 200,000 annual sales. The vertical grille design was ridiculed upon launch, and the car arrived just as the 1958 recession began, creating a perfect storm of bad timing and market rejection.

Ford’s optimism collided hard with reality, leaving dealers scrambling with inventory and no buyers willing to purchase the controversial vehicle.

Financial Impact

Ford spent $250 million developing the Edsel—equivalent to approximately $2.5 billion in today’s money. The car moved only 44,000 units in its second year despite this massive investment.

Ford discontinued the model after just 118,000 total units across all years, suffering catastrophic financial losses that damaged its reputation and forced complete product strategy reassessment.

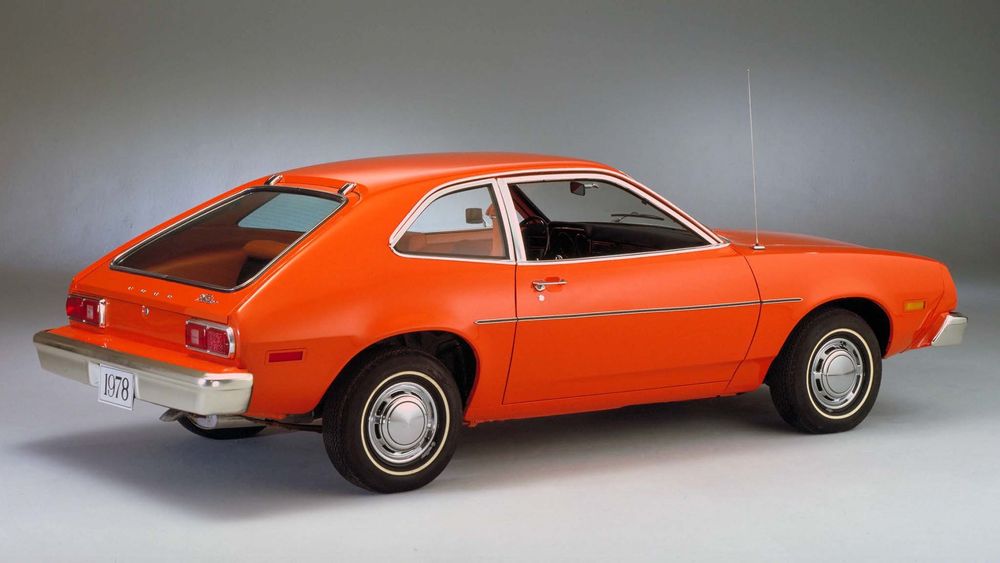

Ford Pinto — The Legal Disaster

In 1971, Ford launched the Pinto with a catastrophic design flaw: its fuel tank positioned directly behind the rear axle, vulnerable to rupturing in rear-end collisions at speeds as low as 20 mph. Ford’s own crash tests revealed the danger.

Ford calculated that repairing the defect would cost $137 million versus an estimated $50 million in lawsuit settlements. The company decided profits mattered more than safety and pushed the Pinto to market as-is.

Financial Ruin

Over 100 lawsuits flooded courts. The landmark Grimshaw v. Ford Motor Company case resulted in a $127.8 million verdict.

Though punitive damages were later reduced to $3.5 million, Ford faced hundreds of additional lawsuits with mounting legal costs threatening company solvency.

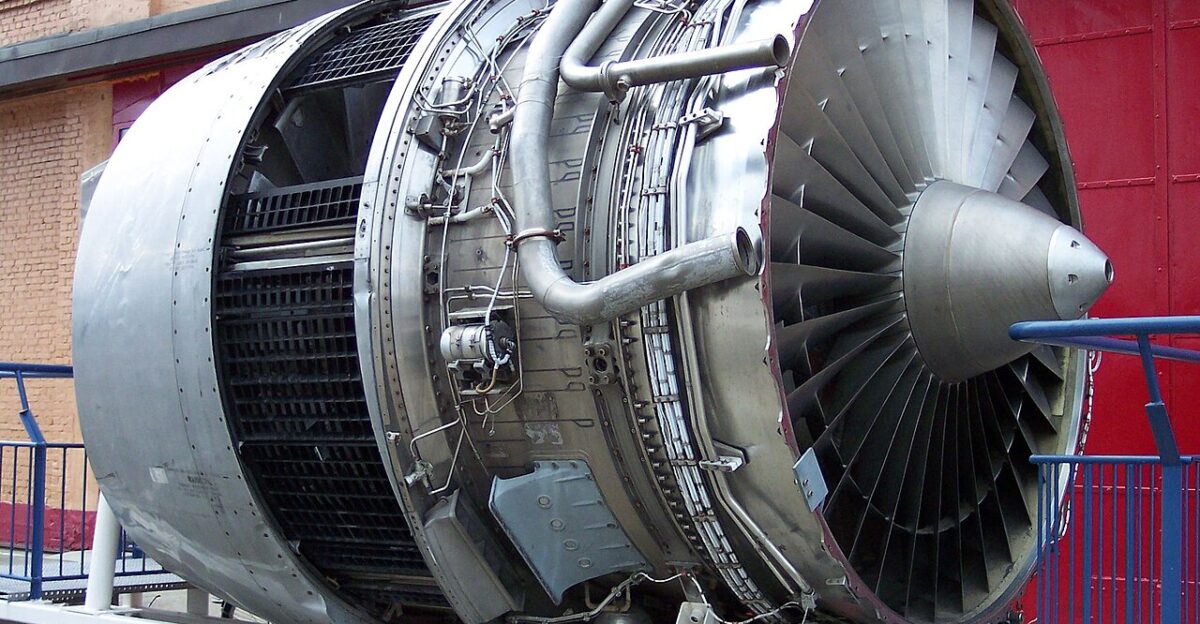

Rolls-Royce RB211 Engine

Rolls-Royce accepted a contract to develop the RB211 turbofan engine for Lockheed’s L-1011 aircraft at a fixed price of £230,375 per unit. The revolutionary triple-spool design faced catastrophic problems—insufficient thrust, excessive weight, and unreliable components.

By September 1970, development costs had skyrocketed to £170.3 million—nearly double the original estimate. Production costs now exceeded selling prices, guaranteeing massive losses on every unit delivered.

Bankruptcy and Nationalization

By February 4, 1971, Rolls-Royce declared bankruptcy—a shocking collapse of one of the world’s most prestigious engineering firms. The British government immediately nationalized the company and injected emergency funding.

Without this rescue, Rolls-Royce would have been liquidated entirely. Ironically, after government intervention and engineering reforms, the RB211 eventually became one of aviation’s most successful jet engines.

Lockheed L-1011 TriStar — Commercial Aircraft Near-Collapse

Lockheed invested $1.4 billion in the L-1011 TriStar by 1970. The RB211 engine development chaos delayed the aircraft by two years, allowing McDonnell Douglas to get its DC-10 to market first.

For profitability, Lockheed needed to sell 500 aircraft. However, by production’s end in 1984, only 250 TriStars had been built—every single one losing money.

Financial Ruin and Retreat from Commercial Aviation

By 1971, Lockheed faced imminent bankruptcy with no way to recoup massive investments. Congress approved an Emergency Loan Guarantee Act for up to $250 million to prevent collapse.

Combined with a mid-1970s bribery scandal costing over $1 billion in lost contracts, Lockheed abandoned commercial aviation entirely. Both Rolls-Royce and Lockheed required massive government bailouts because of a single aircraft program.

Tesla Model 3 Production Hell

Tesla’s Model 3 nearly broke the company. Elon Musk envisioned a fully robotic “alien dreadnought” factory to revolutionize manufacturing. The over-automation strategy backfired spectacularly—robots couldn’t adapt when problems arose, and conveyor systems became bottlenecks.

Tesla promised 5,000 Model 3s per week by late 2017, but was producing only 10% of that target months after launch.

Cash Burn and Near-Bankruptcy

Tesla burned cash at a staggering rate through 2017-2018. In mid-2018, Musk stated Tesla came within about a month of bankruptcy—meaning the company faced potentially fatal cash depletion.

By shifting to hybrid human-robot assembly and building an emergency tent production line, Tesla managed to avoid total financial collapse through desperate improvisation and extreme workforce extension.

DeLorean DMC-12

John DeLorean founded the DeLorean Motor Company to build an American sports car with gull-wing doors and stainless steel body panels. The Northern Ireland government invested approximately $100 million in a manufacturing facility, believing the project would revitalize the region.

DeLorean promised 30,000 cars annually, convincing government officials to invest heavily in what seemed an economic revival opportunity.

Bankruptcy and Fraud Scandal

DeLorean produced only 9,000 vehicles plagued by underpowered engines and poor build quality. Worse, investigations revealed a $23 million “GPD fraud” where development funds were diverted through a British company.

In February 1982, just 12 months after production began, DeLorean Motor Company went into receivership. The government’s $100 million investment was nearly completely lost, and John DeLorean faced criminal charges for cocaine trafficking.

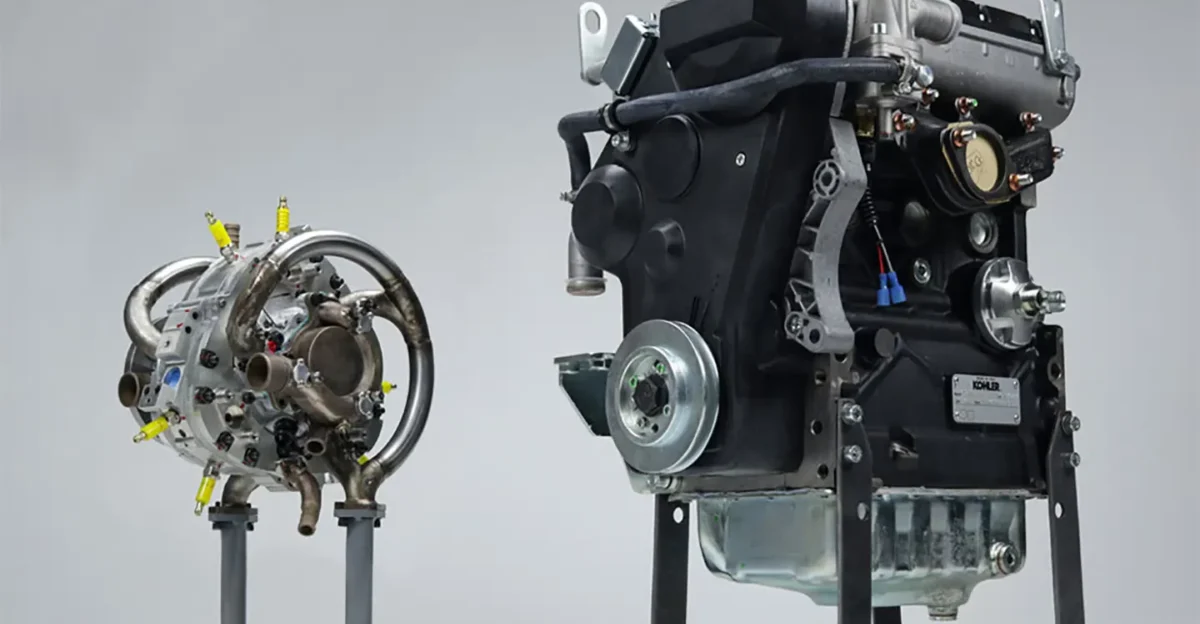

NSU Ro 80 Wankel Engine Catastrophe

The NSU Ro 80 won Car of the Year in 1968 with an advanced twin-rotor Wankel engine and futuristic styling. The car represented automotive innovation at its pinnacle: aerodynamic design with a 0.355 drag coefficient, independent suspensions, and all-round disc brakes.

NSU engineers knew about potential engine seal problems before launch but believed they could solve issues quickly during production. This proved to be a catastrophic miscalculation.

Warranty Devastation and Collapse

The Wankel engine’s rotor tip seals failed catastrophically, often occurring under 25,000 miles. Owners experienced complete engine destruction multiple times under warranty, draining NSU’s finances catastrophically.

By 1969, facing insolvency, Volkswagen acquired the failing NSU and merged it with Auto Union to create Audi. The NSU brand disappeared entirely by 1977.

Bricklin SV1 Financial Disaster

Malcolm Bricklin’s stainless-steel sports car promised market revolution but suffered from poor quality and performance issues from day one. By 1975, just one year after production began, the company filed for bankruptcy.

The Canadian province of New Brunswick, which invested over $23 million in government subsidies, lost nearly the entire investment, marking one of Canada’s most notorious automotive debacles.

Fisker Karma Battery Crisis

The Fisker Karma was a high-performance plug-in hybrid with disappointing battery efficiency and real-world range. Battery fires became a nightmare, particularly during Hurricane Sandy when saltwater exposure led to electrical failures and 12V battery fires.

Fisker’s bankruptcy in November 2013 cost nearly $1 billion in combined government loans ($193 million from the Department of Energy) and private investor funds that were completely lost.

Pontiac Aztek — GM’s Design Catastrophe

General Motors’ Pontiac Aztek (2001-2005) became one of the most reviled vehicles in history—so ugly it was featured in “Breaking Bad” as an incompetent character’s car. Focus groups showed overwhelmingly negative reactions to the design, yet GM’s board ignored feedback.

The company’s arrogance was catastrophic. GM dismissed consumer concerns, resulting in a car so unpopular that customers actively avoided it despite crossovers being the fastest-growing market segment.

Pontiac’s Decline

Sales were devastatingly slow from launch. Over five model years, GM sold fewer than 120,000 units total. Massive financial losses combined with GM’s strategy of selling rebadged Chevrolets under the Pontiac nameplate drained the division of profitability.

The Aztek’s failure accelerated Pontiac’s decline, contributing to the division’s collapse during GM’s 2008-2009 bankruptcy crisis. The brand was discontinued in 2010.

Essential Lessons

Whether through poor product decisions, over-ambitious technology bets, engineering failures, or quality disasters, each story provides essential lessons about consumer preferences and market timing.

The companies that survived learned that survival requires humility and radical adaptation. Those that didn’t survive learned too late that cutting corners on safety or pursuing vanity projects can destroy even legendary companies overnight.

Sources:

EBSCO Research Starters (Law) — Court Finds That Ford Ignored Pinto’s Safety Problems

Taxpayer.net — Fisker Automotive is Auctioned Off: DOE Fails to Save Millions

Curious Droid — RB.211: The Engine That Sank and Then Saved Rolls Royce

SimpleFlying — The Rise & Fall Of The Lockheed L-1011 TriStar

Mosaic Tech — Tesla: From Brink of Bankruptcy (Twice) to World’s Most Valuable Automaker