A commercial cargo ship slowed down in the open waters of the Indian Ocean several hundred miles off Sri Lanka in November 2025. Armed U.S. special operations forces climbed aboard, moved through the vessel, and identified military-linked cargo headed for Iran.

Within hours, the shipment—components tied to missile procurement networks—was destroyed at sea. No arrests were made. The crew was released. The ship sailed on, as if nothing had happened.

Sanctions Tighten, Routes Adapt

Pressure on Iran’s missile programs intensified in late 2025. On September 28, the United Nations reimposed Iran’s arms embargo, targeting missile-related technology transfers.

In April, the U.S. Treasury sanctioned Iranian and Chinese entities linked to sodium perchlorate shipments, a key missile propellant precursor. Despite these measures, maritime flows continued.

Thousands of tons of precursor materials reached Iranian ports, underscoring how sanctions reshape routes—but rarely stop them outright.

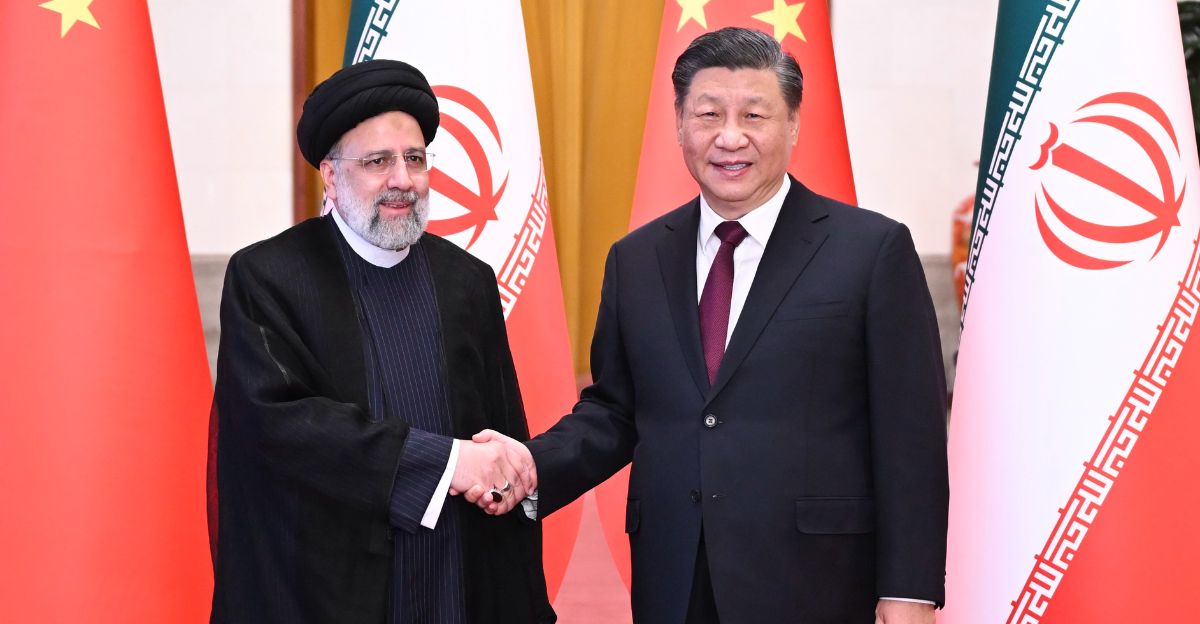

A Relationship Decades in the Making

China-Iran defense ties stretch back to the 1980s, when missile sales surged during the Iran-Iraq War. Transfers peaked in 1987, with significant armed sales that year and evolved through the 1990s, with aircraft, missile systems, and technical assistance valued in the hundreds of millions.

Although UN resolutions beginning in 2006 curbed overt arms sales, dual-use cooperation persisted. Satellite systems, industrial inputs, and long-term agreements kept the relationship alive beneath the surface.

Post-Conflict Pressure Builds

The urgency behind U.S. action grew after Iran’s June 2025 conflict with Israel, which damaged missile production infrastructure. As Tehran moved to rebuild, U.S. lawmakers warned that Chinese chemical shipments could accelerate reconstitution efforts.

Representatives Raja Krishnamoorthi and Joe Courtney urged deeper investigations into procurement routes in letters sent to senior officials in November 2025. With regional tensions unresolved, attention shifted from launch sites to the quieter pipelines that feed missile assembly lines.

A Quiet Boarding at Sea

In November 2025, U.S. special operations forces boarded a commercial vessel in the Indian Ocean, several hundred miles off Sri Lanka. The ship was traveling from China toward Iran.

The team seized military-linked cargo associated with Iranian missile procurement networks, destroyed it on site, and allowed the vessel to continue its voyage. No unit was named, no footage released, and no press conference held—by design.

Why This Shipment Mattered

The destroyed cargo consisted of military-related and dual-use components tied to sanctioned Iranian firms. Guidance and navigation equipment, including accelerometers and gyroscopes, are critical instruments essential for missile control systems—components that command premium prices on international markets due to their specialized precision requirements and tight export controls.

While not finished weapons, such inputs are critical to production timelines. Under international sanctions, replacing these components faces significant hurdles. Procurement networks must navigate tightened export controls, financial restrictions, and heightened interdiction risk.

The Crew Walked Free

The operation demonstrates U.S. commitment to disrupting Iran’s missile supply chains at critical junctures, extending production schedules already strained by infrastructure damage from the June conflict.

The vessel’s crew was not detained, and the ship was not impounded. After the cargo was destroyed, it continued on its route. Analysts note that such operations carry significant human risk, even when crews are uninvolved.

The choice to seize and release reflects a calculated balance—inflicting strategic cost while minimizing diplomatic fallout and legal entanglements in international waters.

Regulatory Pressure Intensifies

U.S. scrutiny of Chinese dual-use exports is not new. Washington froze technology transfers as early as 1987 and has since expanded financial sanctions targeting procurement networks.

In late 2025, lawmakers pressed senior officials to investigate chemical propellant flows more aggressively. The focus has shifted from finished weapons to the industrial arteries that sustain them.

From Missiles to Materials

In earlier decades, China supplied Iran with complete missile systems. Today, assistance more often arrives as materials, components, and technical knowledge.

Missiles like Iran’s Nasr-1 reflect this evolution toward domestic assembly supported by foreign inputs. UN Resolution 2231 relaxed some restrictions after 2015, but the reimposed bans of 2025 have returned these quieter exchanges to the center of international scrutiny.

Energy and Arms Converge

Missile interdictions are part of a wider maritime campaign. As part of broader maritime enforcement, the U.S. has emphasized seizures of sanctioned energy flows connected to Iran, with officials noting coordinated interdiction efforts across global shipping routes.

Together, these operations suggest a strategy that links energy enforcement with arms-control pressure across the world’s seas.

Official Silence, Rising Tension

Iran rejected U.S. calls to curb missile ranges, labeling them unacceptable. Beijing offered no public response to the interdiction. U.S. officials spoke only anonymously, citing operational security. The silence itself became part of the message.

By avoiding public escalation, all sides limited immediate fallout—while leaving the underlying tensions unresolved and increasingly maritime in character.

Command Without Attribution

U.S. officials confirmed the operation but declined to identify the unit involved. Conventional forces supported the mission, echoing earlier supply-chain seizures conducted by other regional commands.

The lack of attribution reflects a shift in military posture: success measured not by publicity, but by what adversaries fail to receive.

Iran Adjusts Its Playbook

Following the seizure, Iran is expected to accelerate domestic production efforts and seek alternative routes. Chinese technical blueprints and industrial know-how remain critical, but sanctions narrow options.

U.S. officials have signaled readiness for further interceptions, forcing Tehran to weigh higher costs, longer timelines, and increased exposure across its procurement networks.

Analysts See a Strategic Shift

Defense analysts describe the boarding as a marker of evolving warfare, with emphasis on disruption rather than destruction.

By striking far from conflict zones, the operation underscores how supply chains—not battlefields—have become primary arenas of competition amid Israel-Iran tensions and broader Indo-Pacific rivalries.

A Question of Deterrence

Will this action deter future shipments or provoke more covert routing? Indo-Pacific Command has increased maritime monitoring, suggesting persistence rather than a one-off strike.

The unanswered question is whether Beijing views such operations as manageable friction—or as a challenge to commercial shipping norms long treated as sacrosanct.

Policy Momentum in Washington

The operation reinforced bipartisan momentum in Congress. Lawmakers renewed calls for investigations linking UN sanctions to enforcement gaps at sea.

By pressing senior officials to act, Congress signaled that missile supply chains—not just missile tests—are now central to U.S. nonproliferation policy.

Global Ripples Spread

China’s 2021 strategic partnership agreement with Iran complicates U.S. alliance management. Recent maritime incidents, including Iran’s seizure of a foreign tanker in November 2025, point to a broader erosion of maritime norms.

As more states test boundaries, boarding rights and enforcement authorities in international waters face renewed legal and diplomatic scrutiny.

The Legal Gray Zone

Dual-use cargo blurs civilian and military distinctions. Iran cites sovereignty; the U.S. cites sanctions enforcement. By destroying cargo and releasing the vessel, Washington avoided courtroom battles while asserting reach.

The absence of vessel identification preserves deniability—but leaves unresolved questions about precedent in open-ocean enforcement.

Changing How the Seas Are Seen

For a generation raised on global trade, oceans once symbolized neutrality and freedom of navigation. Operations like this challenge that assumption. The November interdiction exemplified a strategic shift in how the United States views maritime corridors.

Where ocean-going commerce was once largely beyond state reach, supply chains have become primary battlegrounds in great-power competition.

U.S. officials and defense analysts framed the operation’s broader message in stark terms: maritime routes once treated as secure channels for sanctions-evasion networks are now actively contested spaces.

No Longer Invisible

As shipping lanes become subject to coordinated interdiction efforts, procurement networks face exposure risk at any point along the supply chain, from port of origin to final destination.

Analysts note growing ethical debates around covert interdictions, secrecy, and escalation risks. What was once invisible infrastructure is now recognized as contested space, reshaping how maritime security is understood and how states project power in the 21st century.

Sources:

“U.S. Forces Raid Ship, Seize Cargo Headed to Iran From China.” The Wall Street Journal, 12 Dec 2025.

“Treasury Targets Network Procuring Missile Propellant Ingredients for Iran’s IRGC from China.” U.S. Department of the Treasury, 28 Apr 2025.

“UN arms embargo, other sanctions reimposed on Iran over nuclear programme.” Reuters, 28 Sep 2025.

“Israel-Iran Conflict (2025).” Encyclopaedia Britannica, Dec 2025.