Valve’s Steam Deck LCD, once the $399 gateway to premium portable gaming, is disappearing forever. Valve quietly discontinued its most affordable handheld this month, forcing new buyers to pay a minimum of $549, a $150 price jump that echoes a troubling reality facing the entire gaming hardware industry. As an unprecedented memory chip shortage ravages consumer electronics, affordable entry points are vanishing, and Valve’s decision signals budget gaming hardware may be heading toward extinction. Let’s unpack what changed.

The $399 Dream Is Over

For 3 years, Valve’s Steam Deck LCD offered something rare: premium gaming portability at an accessible price. Launched in February 2022, it transformed handheld gaming and sold approximately 4 million units. This month, Valve quietly confirmed it’s phasing out the 256GB model entirely, via a small disclaimer on the Steam Deck store page. That tiny update points to a much bigger shift.

Meet The New Minimum: $549

If you want a new Steam Deck now, you’re paying at least $549 for the OLED 512GB model, a full $150 more than the discontinued LCD version. The premium 1TB OLED option rises to $649. Valve offered no detailed explanation for pulling the entry model. For buyers already squeezed by inflation and tariffs, the sudden floor change lands hard.

Why The Timing Suddenly Makes Sense

Behind Valve’s move sits a semiconductor shock hitting memory hardest. Memory chip prices surged 300% between September and December 2025 as AI data centers consumed supply. DRAM spot prices jumped from $6.84 per 16-gigabit chip to $27.20, nearly 4x in 90 days. When core components spike that fast, a $399 promise gets fragile.

“The AI-Driven Growth…Has Led To A Surge”

“The AI-driven growth in the data center has led to a surge in demand for memory and storage. Micron has made the difficult decision to exit the Crucial consumer business in order to improve supply and support for our larger, strategic customers in faster-growing segments,” announced Sumit Sadana, EVP and Chief Business Officer at Micron Technology, on December 3, 2025. The fallout is immediate.

The Shortage Nobody Planned For

Samsung, SK Hynix, and Micron control roughly 70% of global DRAM production, and all 3 redirected capacity toward high-bandwidth memory for AI accelerators instead of expanding consumer-grade supply. This wasn’t a brief disruption, but a strategic pivot toward higher margins. Analysts expect shortages to linger into 2027, leaving manufacturers little room to wait.

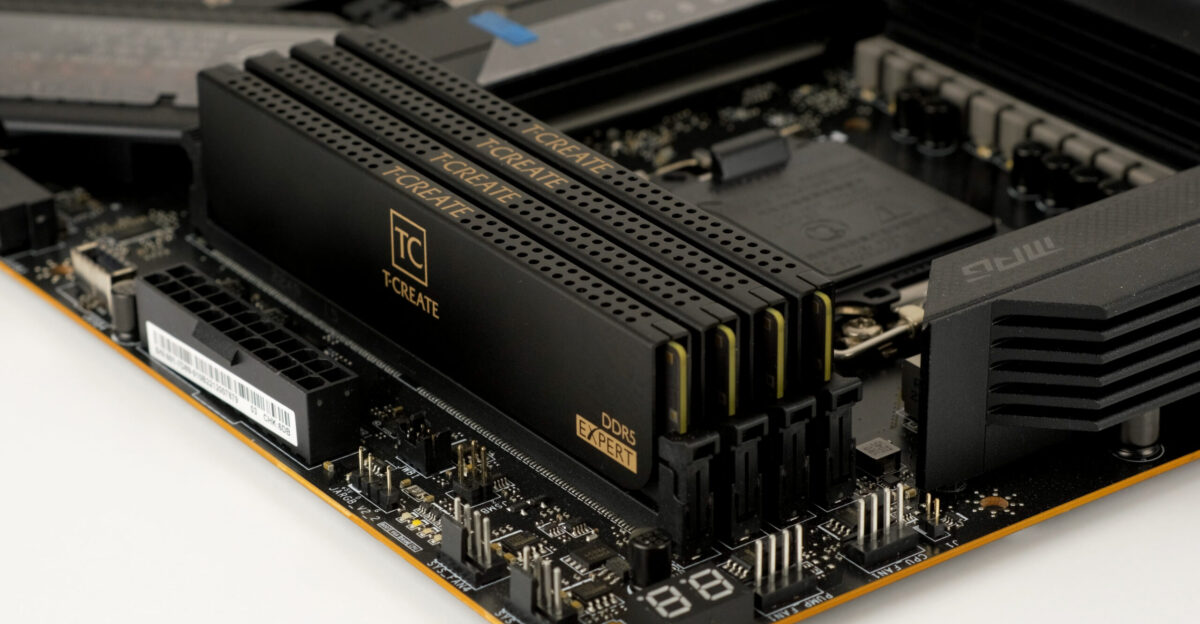

DDR5 Prices Crossed A Breaking Point

Component inflation quickly hit real shelves. A DDR5 16-gigabyte module, costing approximately $260 in October 2025, rose to $498 by November, a 91% increase in one month. Kingston cited a 246% increase in NAND pricing versus Q1 2025, with 70% of that spike occurring in the prior 60 days. The panic didn’t cool.

Hardware Sales Are Crashing Anyway

Valve’s decision came at a time when the broader market was weakening. In November 2025, US gaming hardware sales reached 1.6 million units, marking the lowest November total since 1995, according to Circana. Console spending dropped 27% year-over-year to $695 million, the worst November since 2005. Average hardware prices reached $439, a 11% increase, and buyers are clearly hesitating.

Gen Z Is Pulling Back Hard

The most likely audience for a $399 handheld is also cutting spending. Gen Z gamers, aged 18-24, reduced their game spending by nearly 25% in 2024, according to Circana, as they were pressured by student loan payments resuming, weak job markets, and rising credit card delinquencies. That group relied on a cheaper entry point that Valve just removed. So why discount it first?

Black Friday Looked Generous, In Hindsight

In November 2025, Valve discounted the Steam Deck LCD by 20% during Black Friday and Cyber Monday, reducing its price to approximately $319. At the time, it appeared to be a rare deal in a pricey market. Now it reads more like inventory liquidation before discontinuation. The clues were visible, just easy to miss when buyers assumed restocks would follow.

Nintendo Quietly Benefits From Valve’s Move

At $449.99, Nintendo Switch 2 becomes the most affordable premium handheld once the Steam Deck LCD is gone. Switch 2 sold 10 million units in its first four months after its June 2025 launch, demonstrating strong demand despite broader market weakness. In November, it ranked 2nd in US hardware sales behind PlayStation 5. The new price floor reshapes competition.

Premium Handhelds Keep Selling

The surprise is that expensive handhelds are doing fine. ASUS said its ROG Xbox Ally X, priced at $799-$1,000 and launched in October 2025, saw demand exceed production expectations. ASUS projected NT$4-5 billion ($128-$160 million) in quarterly revenue from the Ally lineup, with high-end variants in short supply. Consumers aren’t fleeing handheld gaming, just cheap options.

A Market Splitting Into 2 Worlds

Gaming hardware now looks bifurcated: premium devices at $450+ show resilient demand, while budget alternatives fade. ASUS specifically pointed to shortages for high-end ROG Ally X models, while cheaper base models weren’t described as scarce. Similar patterns appear in consoles, where PlayStation 5 and Switch 2 keep momentum. Could budget hardware be structurally disappearing, not merely delayed?

Price Hikes Are Everywhere, Not Just Valve

Valve’s move fits a wider pattern. Sony raised PlayStation 5 prices to $549-$749 in August 2025, and Microsoft increased Xbox Series prices in September 2025. Nintendo held Switch 2 at $449.99 but pushed premium bundles. Framework also announced memory price hikes twice in 2 months, saying memory costs about $10 per gigabyte versus roughly $5-6 just 6 months earlier.

Micron’s Consumer Exit Changes The Stakes

When Micron ended its Crucial consumer brand in December 2025, closing 29 years of consumer memory products, it signaled deeper industry priorities. The company said it was exiting consumer business “to improve supply and support for our larger, strategic customers in faster-growing segments.” In plain terms, AI infrastructure pays so well that consumer electronics can be deprioritized, even if consumers pay more.

When Prices Might Ease Again

Industry expectations are bleak for bargain hunters. Many forecasts say memory supply won’t normalize until late 2027 at the earliest, possibly extending into 2028. Samsung, SK Hynix, and others are building new fabs, but manufacturing expansion typically takes 2-3 years to produce usable capacity. Kingston’s Cameron Crandall warned that memory “prices are going to continue to go up” into 2026.

Subscriptions Start Looking Like The Budget Path

As devices climb, subscription services become a workaround. Xbox Game Pass Ultimate costs $14.99 per month and includes an extensive library, as well as cloud gaming streaming. PlayStation Plus Premium offers a similar pitch. For people priced out of handhelds costing $ 550 or more, a monthly payment of $25-$30 can feel more accessible than a major upfront purchase. The catch is what happens when subscriptions become the new gatekeeper.

Budget Gamers Now Face Tough Tradeoffs

Budget-conscious players have limited routes. Option 1: pay $549+ for Steam Deck OLED. Option 2: buy Nintendo Switch 2 at $449.99, assuming its library fits your tastes. Option 3: rely on free-to-play mobile games, a segment generating $92 billion annually, about 49% of gaming’s total market. Option 4: cloud subscriptions at $15-$30 monthly, trading ownership for access.

Valve’s New Hardware Plans Tell A Story

In December 2025, Valve also announced three hardware products shipping in early 2026: the Steam Machine, a living room console priced around $599-$700, a new Steam Controller, and the Steam Frame, a wireless VR headset. Notably missing was any new affordable handheld. The roadmap reads like an intentional move upmarket across categories, suggesting the budget era isn’t just paused.

The Accessibility Problem People Avoid Naming

Gaming grows when there’s an easy way in. If budget handhelds vanish, the industry weakens the pipeline that moves casual players toward deeper, more expensive ecosystems. This hits hardest for lower-income consumers in developed markets and for players in developing regions. Premium positioning can lift margins in the short term, but it risks shrinking the next generation of buyers. So what model fills the gap?

Premium Hardware Or Subscription Future

The industry is at a fork: double down on premium hardware mainly for affluent buyers, or expand subscription and cloud access that reduces hardware dependence. Valve ending the Steam Deck LCD effectively chooses the premium path for now. However, as memory shortages persist and component costs remain high, service-based gaming becomes increasingly attractive to people priced out of new devices. The real question is which side wins by 2027.

Sources

Micron Announces Exit Crucial Consumer Business. Micron Technology, December 3, 2025

US Video Game Market Sales November 2025. Circana, November 2025

Steam Deck Store Page Disclaimer On LCD Availability. Valve Steam Store, December 2025

RAM Pricing Crisis And Market Warnings. Tom’s Hardware, 2025