U.S. special operations forces boarded a cargo ship hundreds of miles off Sri Lanka in November, seizing and destroying military-grade components from China destined for Iran. This marked the first known interception of such Chinese-origin weapons headed to Tehran in recent years, highlighting ongoing gaps in global arms control efforts.

According to the Wall Street Journal and U.S. Special Operations Command, the operation exposed vulnerabilities in monitoring illicit weapons transfers. The seizure underscores heightened tensions over China’s role in Iran’s military buildup. Here’s what’s happening next in this complex supply chain.

The Critical Moment That Changed Everything

The June 2025 Iran-Israel conflict left Tehran’s military significantly weakened. Israeli forces reported destroying over one-third of Iran’s air defense systems, missile batteries, and conventional military infrastructure. U.S. and Israeli assessments confirmed strikes on Iran’s nuclear facilities at Fordow, Natanz, and Isfahan, setting back the country’s nuclear program by an estimated two years, according to Pentagon briefings and Israeli Defense Force statements.

Iran’s solid-fuel missile production facilities, including planetary mixer equipment vital for advanced missile manufacturing, were also targeted. Facing this deterrence gap, Tehran accelerated rearmament, relying on global procurement networks to replace lost capabilities. The conflict reshaped regional military dynamics and set the stage for an increasingly sophisticated arms supply chain.

Beijing’s Calculated Decision to Arm Tehran

China’s 2021 $400 billion, 25-year strategic partnership with Iran shifted from broad economic collaboration to a direct defense-industrial relationship after the June 2025 conflict. Senior U.S. officials say this arrangement provides Iran with advanced dual-use technology while offering the People’s Liberation Army operational intelligence from Iranian military applications.

Chinese strategists view Iran as a partner capable of disrupting U.S. naval operations in strategic chokepoints like the Strait of Hormuz, according to the U.S.-China Commission on strategic competition analysis. This long-term cooperation demonstrates China’s willingness to bolster Iran’s military capabilities despite international scrutiny, complicating enforcement of existing sanctions and arms embargoes.

How the Weapons Pipeline Actually Works

The Iran-China arms supply chain operates through shell companies and intermediaries across eight countries. In April 2025, the U.S. Treasury designated six Iranian entities, five Chinese firms, and one Iranian company for procuring sodium perchlorate and dioctyl sebacate, key ingredients for solid-rocket motors, according to Treasury press releases.

Firms including Shenzhen Amor Logistics, E-Sail Shipping, Yanling Chuanxing, and Dongying Weiaien managed logistics and coordination. Despite sanctions, the network proved resilient, demonstrating systematic circumvention of export controls. This web of intermediaries highlights the challenges U.S. authorities face in disrupting state-backed arms procurement in an increasingly globalized market.

On April 28, 2025, Treasury Secretary Janet Yellen imposed comprehensive sanctions targeting the Iran-China procurement network. Yet shipments continued. Lawmakers reported about 2,000 tons of sodium perchlorate arriving at Bandar Abbas since late September 2025, enough to produce 500 mid-range missiles in violation of UN protocols, according to Iran International reporting.

An additional 1,000 tons landed in June, underscoring the network’s resilience. These ongoing deliveries reveal the limitations of sanctions enforcement and the speed with which Tehran’s procurement system adapts. Even high-profile Treasury designations could not fully halt the flow of critical missile components, exposing persistent enforcement gaps.

On April 26, 2025, an explosion at the Port of Shahid Rajaee in Bandar Abbas killed at least 57 people and injured over 1,000, according to official Iranian statements and independent media verification. The blast involved sodium perchlorate stored at the port, confirming the pace of Iran’s propellant imports.

The incident unintentionally revealed the scale of the supply chain, highlighting how conventional sanctions enforcement struggles to keep up. It demonstrated that Iran’s rearmament strategy relies on a network capable of moving massive quantities of critical materials quickly and discreetly, underscoring the operational challenges for international regulators.

Washington Escalates Its Response

On November 11, 2025, the U.S. Treasury designated 32 entities across eight countries—including the UAE, Turkey, China, Hong Kong, India, Germany, and Ukraine—disrupting key nodes in the Iran-China network, according to the Department of Treasury. Financial institutions were ordered to freeze related assets, prompting compliance from international insurers and banks.

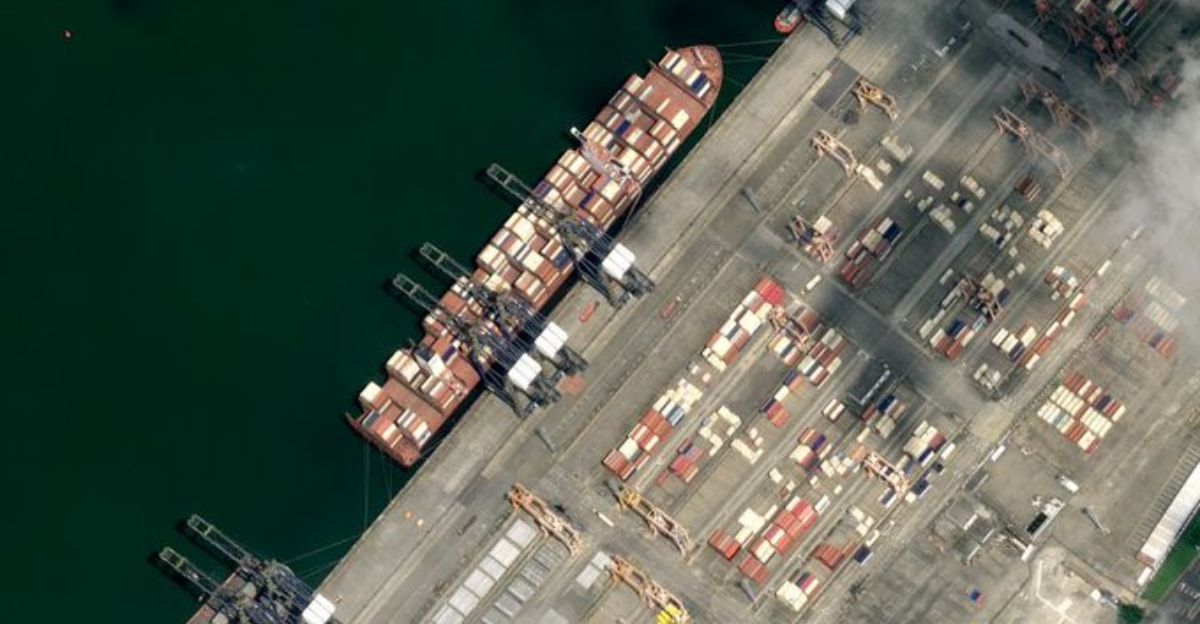

Weeks later, U.S. special operations forces executed a maritime interdiction in the Indian Ocean, seizing precision-guidance systems, gyroscopes, accelerometers, and electronics for solid-fuel missile systems. The vessel was released after cargo removal to avoid diplomatic escalation. The operation showcased U.S. capability while illustrating that bulk shipments continue despite enforcement measures, highlighting ongoing strategic challenges.

The November operation relied on signals intelligence, human intelligence, open-source vessel data, and crew communications. Conducted under UN arms embargo provisions reinstated on September 27, 2025, the seizure prevented delivery of dual-use technology but intercepted only a fraction of the flow. Since late September, about 2,000 tons of propellant precursors valued at $20–40 million reached Iran, supporting domestic missile production and proxy transfers.

Ongoing congressional investigations, expanded Treasury designations, and U.S. intelligence assessments point to active Chinese facilitation. Historical arms transfers peaked at $539 million in 1987, and China now maintains 366 entities under U.S. sanctions targeting weapons procurement networks. Interceptions demonstrate operational capability but also expose persistent enforcement limitations, leaving policymakers with difficult strategic choices.

Strategic Stakes and Lessons

The Iran-China arms supply network illustrates the limits of sanctions and maritime interdictions in controlling state-to-state arms flows. While U.S. operations have successfully disrupted shipments, bulk deliveries continue, highlighting enforcement challenges amid rising global tensions. Policymakers must balance operational successes against the broader strategic reality of persistent procurement networks.

This case underscores the ongoing complexity of international arms control. With Beijing’s demonstrated commitment to Tehran’s rearmament, the stakes extend beyond immediate interdictions. Understanding and countering these sophisticated supply chains will shape regional security and global nonproliferation efforts for years to come.

Sources:

“U.S. Boarded Ship and Seized Cargo Heading to Iran From China.” Wall Street Journal, December 12, 2025.

“Treasury Disrupts Iran’s Transnational Missile and UAV Program.” U.S. Department of Treasury Press Release, November 11, 2025.

“Treasury Targets Network Procuring Missile Propellant Precursor for Iran.” U.S. Department of Treasury Press Release, April 28, 2025.

“The IDF Has Destroyed One-Third of the Iranian Regime’s Conventional Military Capabilities.” Israel Defense Force Press Release, June 15, 2025.

“Iranian nuclear program degraded by up to two years, Pentagon says.” Reuters, July 3, 2025.

“Iran–China 25-year Cooperation Program.” Wikipedia (sourced from official Chinese and Iranian government announcements), 2020-2025 period.

“China’s Facilitation of Sanctions and Export Control Evasion.” U.S.-China Economic and Security Review Commission, November 2025.