Imagine your grandfather bought a quirky car in the 1970s that dealers literally couldn’t sell. Fast forward 50 years, and that automotive wallflower now outvalues many luxury penthouses. Six American performance cars once dismissed as commercial flops are commanding astronomical prices today. Some appreciate 8,000%+, others doubled or tripled. Here’s what’s going on behind these surprising investments.

When Detroit’s Coolest Cars Flopped

Detroit built radical machines with jaw-dropping design and impressive specs, yet they gathered dust on dealer lots. The 1970 Plymouth Superbird’s massive rear wing looked alien. Boss 429 Mustangs were limited homologation specials. Early DeLoreans had reliability problems. They failed not from a lack of merit but because the market didn’t understand them. Today, collectors spot their true worth.

The Collector’s Secret: Why Failure Pays

Commercial failure is the hidden ingredient behind massive car appreciation. Limited production ensures fewer survive accidents, rust, and neglect over decades. A DeLorean or Superbird’s scarcity today fuels fierce competition. Cars sold in low quantities appreciate faster than mass-market vehicles. Collectors compete for the remaining handful, driving prices skyward and turning forgotten flops into coveted treasures.

How Popular Culture Rewrites Value

Movies can redefine a car’s legacy. The DeLorean DMC-12 was nearly forgotten before it gained fame in Back to the Future in 1985. Overnight, its stainless-steel design became iconic. Cultural relevance transformed an economic failure into a pop-culture legend. Intrinsic engineering matters, but nostalgia, context, and emotional resonance can multiply value. Sometimes being different only requires the right moment to become legendary.

Historic Prices vs. Modern Gains

Original 1970s muscle cars cost between $3,500 and $5,000. Today, they sell for $300,000–$700,000, representing an 8,000%–14,000% increase over the past 50 years. The Vector W8 cost $450,000 in 1990 (~$1.2 million today) and now sells for between $300,000 and $720,000. Condition, provenance, and rarity determine whether you get $100,000 or $1 million. Numbers tell the story, but context drives premiums in classic cars.

The Six Cars That Changed Everything

You’ve seen why failure and culture fuel value, now let’s meet the cars creating fortunes. These six American performance machines show how a $5,000 mistake can turn into a $600,000 asset. From futuristic designs to legendary engines, each entry tells a story of misunderstanding, redemption, and explosive appreciation. Ready to see which cars transformed collectors’ lives?

1. Shelby GT350 (1967)

Price Then: ~$3,995 | Price Now: $150,000–$500,000

Carroll Shelby adapted the Mustang Fastback into a race-ready machine. Independent suspension, competition brakes, and a high-revving 289-cubic-inch engine distinguish it. Yet buyers preferred cheaper Boss variants. Early examples appreciated slowly until enthusiasts recognized Shelby’s genius. Today, documented 1967 GT350s command $150,000–$500,000, with some examples exceeding $600,000. Innovation often overlooked initially can later earn enormous value, proving to be a rare engineering win.

2. Vector W8 Twin Turbo (1990)

Price Then: $450,000 | Price Now: $300,000–$720,000

Jerry Wiegert’s Vector W8 aimed to be the ultimate American supercar. Only 17 units were produced before the company went bankrupt. A claimed 242-mph top speed made it exotic, yet reliability issues scared buyers. Modern collectors prize each for rarity and engineering significance. Recent sales have spanned $300,000–$720,000, and enthusiasts argue that the extreme rarity could justify even higher valuations for such a radical, historical design.

3. DeLorean DMC-12 (1981–1983)

Price Then: $25,000 | Price Now: $50,000–$95,000 (Regular Models)

John DeLorean’s stainless-steel car was a commercial and engineering disaster. Only 9,000 units were made before the 1982 bankruptcy. Complaints about low power and reliability plagued buyers. Back to the Future in 1985 transformed the DeLorean Motor Company’s DMC-12 into an icon. Today, regular models sell for $50,000–$95,000, a modest gain. Movie cars fetch far more, illustrating how culture significantly affects collector pricing.

4. Chevrolet Camaro Yenko (1967)

Price Then: ~$3,700 | Price Now: $500,000–$700,000+

Don Yenko converted 54 Camaros into muscle car legends with bigger engines and upgraded suspensions. Dealer specials then were niche items, now blue-chip collectibles. A 1967 Yenko sold for $709,000 at RM Sotheby’s in 2025. Extreme rarity and documented provenance combine for powerful appreciation. The Yenko shows that low-production, well-engineered cars can outperform expectations decades after their initial release.

5. Ford Mustang Boss 429 (1969)

Price Then: ~$4,800 | Price Now: $350,000–$580,000

The Boss 429 homologated a 429-cubic-inch racing engine with 375 hp and 450 lb-ft torque. Only 1,356 were built between 1969–1970. Muscle buyers initially ignored them. Today, pristine examples sell for $350,000–$580,000, with some reaching over $600,000. Its rarity, legitimate performance, and iconic design prove that production limits combined with engineering excellence create enormous long-term collector value in American muscle.

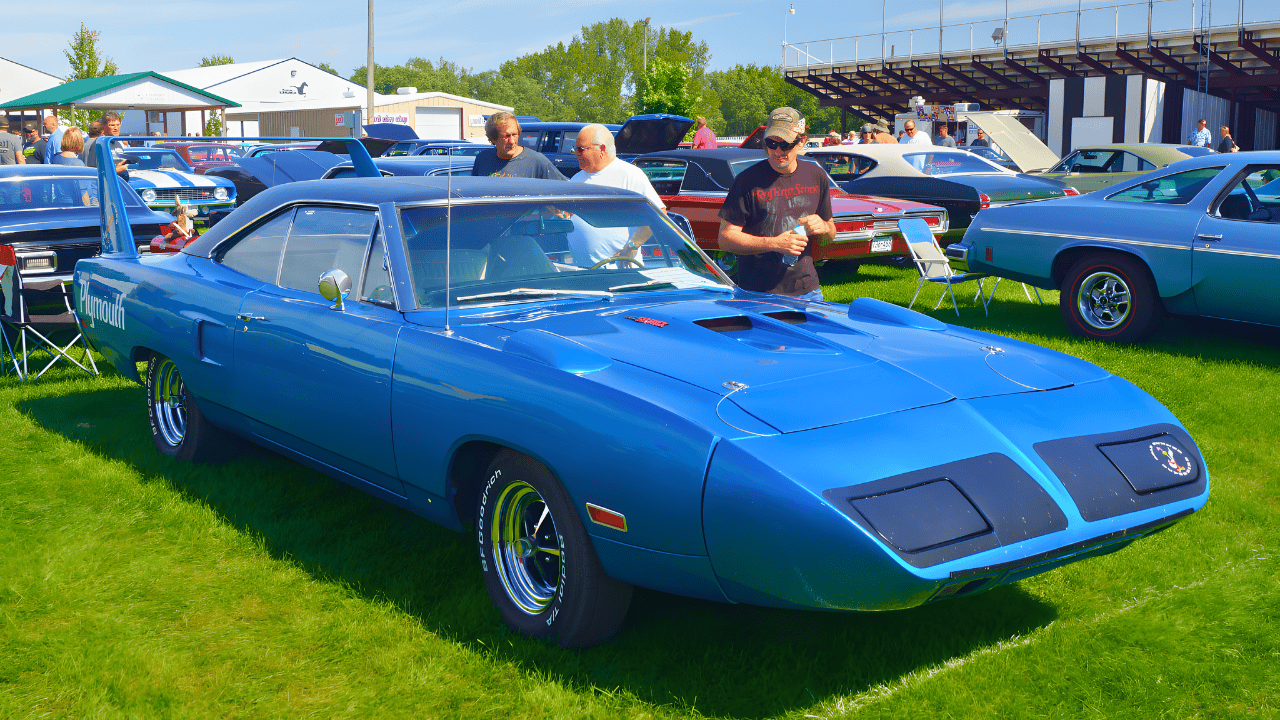

6. Plymouth Superbird (1970)

Price Then: ~$4,300 | Price Now: $400,000–$600,000 | Record: $1.65M (2022)

The Superbird’s giant rear wing seemed absurd in 1970. Dealers struggled to sell 1,920 units, most of which were destroyed in the 1990s. Today, ~1,000 survive. Radical design and 375–440 hp engines drive demand. Typical prices range from $400,000 to $600,000. Record sales reached $1.65 million but were later resold for $418,000, suggesting buyer’s remorse for outliers. Realistic valuations range from $450,000 to $550,000 for excellent examples.

Why Limited Production Matters

All six cars share limited production: Yenko Camaro 54, Vector W8 17, Boss 429 1,356, Superbird 1,920. Mainstream Camaros and Mustangs sold hundreds of thousands. Scarcity drives fierce collector competition. When only a few exist worldwide, demand far exceeds supply. Limited numbers often trump speed, style, or horsepower in determining value, proving scarcity is a critical factor in modern collectible car markets.

Condition Determines Value

Two identical 1969 Boss 429s can sell for $250,000 and $580,000. Condition makes the difference. “Fair” examples fetch $240,000; “excellent” $410,000; concours-quality $580,000+. Original paint, documentation, and low mileage increase value, while restorations and unknown provenance lower it. Collectors pay massive premiums for authenticity. In many cases, a “garage find” outprices a restored clone by over $200,000.

Provenance Adds Premiums

Ownership history can skyrocket prices. A regular 1981 DeLorean sells for $50,000–$95,000. A Back to the Future movie car sold for $541,200. Famous owners, cultural significance, or documented history can enhance value beyond specifications. The Superbird and Boss 429 illustrate this principle. A compelling story often matters as much as rarity or horsepower when collectors bid aggressively at auctions.

Adjusting For Inflation

Original prices, such as $4,300 (Superbird) and $4,800 (Boss 429), require an inflation context. $4,300 in 1970 equals ~$32,000 today. A $500,000 Superbird represents $468,000 above inflation. The DeLorean’s $25,000 in 1981 is equivalent to approximately $75,000; the current $60,000 examples represent a loss of real purchasing power. Vector W8’s $450,000 (~$1.2 million today) now sells for ~$400,000. Enthusiasm drives some gains more than pure math.

Market Volatility Explains Swings

Classic car prices aren’t stable. A 1970 Superbird sold $1.65M in 2022, then $418,000 in 2025—a 75% drop. Auction fever, celebrity attention, and collector enthusiasm create temporary spikes. Economic downturns and generational shifts also affect values. Smart collectors prioritize market valleys over chasing peak prices. Timing and patience matter more than chasing headline sales.

Hidden Costs Every Collector Faces

Owning a $500,000 classic isn’t just about the purchase price. Insurance on a Yenko or Boss 429 costs $2,000–$5,000 annually. Climate-controlled storage costs $500–$2,000 per month. Maintenance, restoration, transport, and registration can easily reach $100,000–$300,000 over a decade. A Superbird appreciating from $300,000 to $500,000 sees net gains drop by half after expenses. Genuine appreciation needs careful budgeting.

Investment Lessons From Six Classics

These cars reveal counterintuitive investment truths. Commercial failure predicts scarcity, which predicts appreciation. Radical designs and low production create collector demand. Cultural significance multiplies value, as seen with Back to the Future. Rarity trumps specs, with condition and documentation adding premiums. Classic cars often outperform inflation, although not as consistently as stocks. Early recognition of overlooked opportunities is key.

Should You Hunt These Cars Today?

Pristine 1967 Yenko Camaros or 1969 Boss 429s remain worthwhile if you have $500,000+ and can wait a decade. Spectacular gains from today’s market are mostly behind us. Modern collectors understand rarity. Real opportunities lie in overlooked vehicles that could be valuable in 2050. Radical design, limited production, and engineering innovation often determine which cars become tomorrow’s treasures.

Sources:

Was This Plymouth’s Plummet from $1.65M to $418K a Reality Check? Hagerty, May 26, 2025

Here’s How Much The 1969 Ford Mustang Boss 429 Is Worth Today. HotCars, May 17, 2024

DMC DeLorean. Wikipedia, January 26, 2005

Shelby GT350 | Munich 2025. RM Sotheby’s, October 17, 2025

1967 Chevrolet Yenko Super Camaro 450 | Monterey 2025. RM Sotheby’s, August 15, 2025

This Is What A Vector W8 Is Worth Today. HotCars, published date unavailable