Recent headlines proclaiming Australian geologists “uncovered” a 55-billion-ton iron ore deposit in June 2025 contain significant inaccuracies. While rooted in genuine scientific research, these claims misrepresent both the discovery’s timing and nature.

The actual breakthrough—a geological re-dating study—was published in July 2024, not 2025, and involves deposits mined for over six decades.

What Scientists Actually Discovered

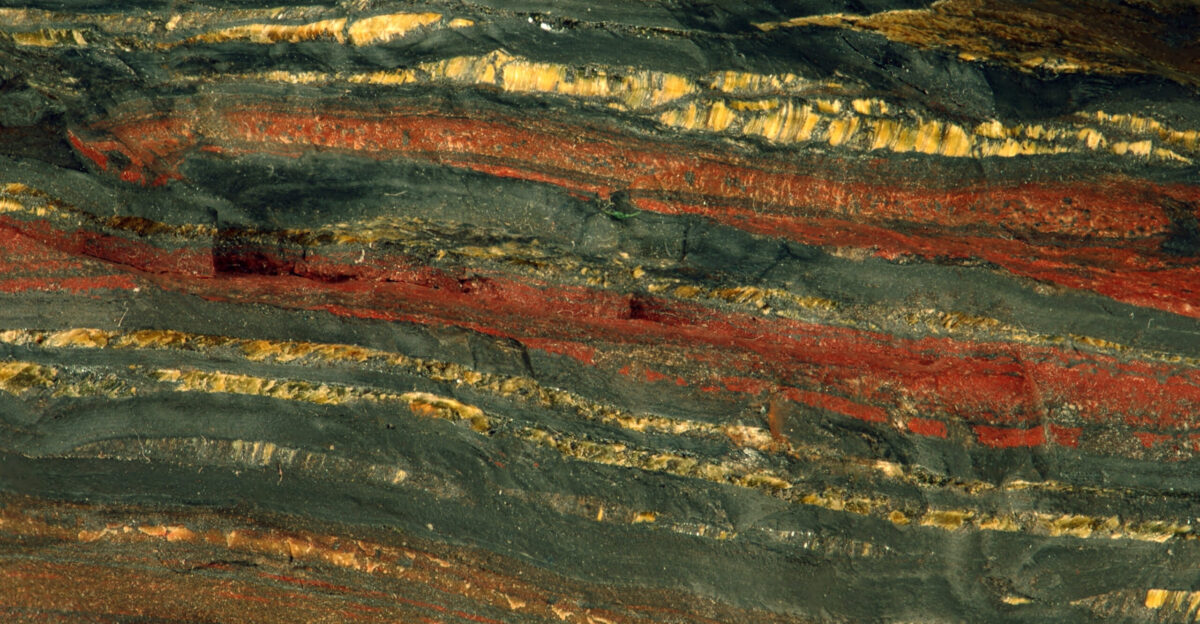

Researchers at Curtin University, led by Dr. Liam Courtney-Davies, achieved a methodological triumph by directly dating hematite ore minerals using uranium-lead isotopic analysis.

Published in Proceedings of the National Academy of Sciences on July 22, 2024, the study revealed Western Australia’s Hamersley iron deposits formed 1.4–1.1 billion years ago—not 2.2 billion years as previously believed.

A Billion-Year Revision Rewrites Geology

This age revision of up to one billion years fundamentally reshapes understanding of Earth’s largest iron ore deposits. The findings disconnect ore formation from the Great Oxidation Event and instead link enrichment to Rodinia supercontinent assembly during the Mesoproterozoic era.

This paradigm shift affects exploration strategies and theories about planetary mineral formation processes.

Not a New Discovery: Decades of Mining History

The Hamersley iron fields have been continuously mined since the 1960s, following prospector Lang Hancock’s famous aerial observation of rust-red ridges.

Rio Tinto, BHP, and Fortescue Metals Group have extracted billions of tons from these deposits over six decades. The scientific advance lies in understanding when formations achieved ore grade, not finding previously unknown resources.

Why June 2025 Confusion Emerged

Media confusion stems from overlapping events in mid-2025. Rio Tinto and China Baowu Steel Group opened the Western Range mine on June 6, 2025—a $2 billion joint venture in the Hamersley region with 25-million-ton annual capacity.

Coverage of this commercial development frequently cited the broader deposits’ $6 trillion valuation, blurring distinctions between new mining operations and 2024 geological findings.

Secondary Sources Amplified Inaccuracies

Economic and mining publications throughout late 2024 and 2025 recycled the geological discovery with increasingly dramatic framing. Articles titled “Worldwide Panic as Monumental Geological Find Disrupts Global Trade” proliferated across platforms.

Many inaccurately portrayed scientific re-dating as equivalent to finding entirely new deposits, using “uncovered” or “discovered” language rather than accurately describing chronological revision of known resources.

The Numbers: What’s Accurate, What’s Not

The 55-billion-metric-ton figure accurately reflects cumulative high-grade resources across the Hamersley Province, encompassing deposits held by three dominant operators. The ore’s iron concentration exceeding 60% is well-established through decades of mining data.

At this grade, Pilbara ore qualifies as direct shipping ore, requiring minimal processing—a critical competitive advantage over lower-grade alternatives.

$6 Trillion Valuation Requires Context

The widely cited $6 trillion valuation represents simplified arithmetic using benchmark prices between $95–$110 per metric ton observed in 2024–2025.

However, this figure warrants significant caveats. Iron ore prices fluctuated between $75–$144 per ton during 2024, with forecasts projecting potential declines to $74–$85 by 2026–2027 as supply increases and Chinese steel demand moderates.

The “26 Years” Claim: Primary vs. Total Steel Production

The 26-year figure requires critical context about steel production pathways. This estimate applies specifically to primary steel production from virgin iron ore (~1.5 billion tons annually), which excludes the ~30% of global steel manufactured from recycled scrap in electric arc furnaces. When calculated against primary steel demand alone, the 55-billion-ton deposit could theoretically supply approximately 26-27 years.

However, when measured against total global steel production—1.9 billion tons annually including scrap-based secondary production—the deposit would supply 18-21 years based on iron ore consumption rates of 2.5-3.0 billion tons per year. The distinction matters: headlines citing “26 years” reference a narrower calculation that excludes recycling’s growing contribution to steel supply, while the lower range reflects comprehensive demand including both virgin ore and scrap feedstock.

Australia’s Iron Ore Dominance

Australia produced approximately 960 million tons of iron ore in 2023, representing 38.6% of global output. Brazil followed with 440 million tons, while China produced 280 million tons domestically despite being the world’s largest consumer.

Western Australia’s Pilbara region serves as the primary source, with established infrastructure supporting efficient extraction and export operations.

Market Destabilization Claims Are Overblown

The iron ore market experienced significant destabilization throughout 2024-2025, with prices plummeting 30% and recording the worst performance among all commodities. This stemmed from converging factors: viral misreporting of the geological study as a ‘new discovery,’ actual new supply from Guinea’s Simandou project (120 million tons annually), and China’s strategic repositioning.

While Hamersley deposits have been mined for decades, the confluence of events surrounding their re-dating study—combined with genuine supply additions—triggered what industry analysts characterized as market-destabilizing volatility.

The geological re-dating changes scientific understanding but doesn’t alter physical availability, extraction economics, or market positioning of these long-established resources.

China’s Steel Demand Drives Market Dynamics

Chinese steel mills and traders increased port stockpiles from 114.5 million tons at year-end 2023 to 146.85 million tons by December 2024—a 28.3% increase through deliberate counter-cyclical purchasing.

With 65%+ dependence on Australian ore, China’s strategic inventory management creates buffer capacity that accommodates incremental supply growth without price collapse. Steel production remains above one billion tons annually despite real estate sector challenges.

The Real Supply Story: Guinea’s Simandou Project

The genuine supply-side development for 2025–2027 centers on Guinea’s Simandou project, which commenced ore shipments in November 2025.

Scaling to 120 million tons annually by 2030, this represents entirely new supply from one of Earth’s highest-grade deposits (over 65% iron), developed through $15+ billion investment. Simandou’s ramp-up—not Hamersley’s continuation—drives analyst forecasts for oversupply and price pressure.

Price Outlook: Gradual Decline, Not Collapse

The Australian Department of Industry forecasts benchmark prices declining from $93 per metric ton in 2024 to $87 in 2025, $85 in 2026, and $82 in 2027. BMI Research anticipates a multi-year downtrend to $78 by 2034, driven by China’s structural shift toward services and scrap recycling.

However, prices demonstrated resilience above $90 through December 2025, prompting some analysts to revise bearish outlooks upward.

Geological Breakthrough’s True Significance

The billion-year age revision carries profound implications for planetary science. Previous models positioned major iron ore enrichment during the Great Oxidation Event 2.4–2.0 billion years ago.

The new chronology instead demonstrates that economic deposits formed during the Mesoproterozoic “balanced billion,” when episodic tectonic events during supercontinent cycles created localized conditions conducive to massive hydrothermal ore formation.

Implications for Future Exploration

The recalibrated formation model enhances predictive capacity for identifying additional giant deposits worldwide. Traditional exploration focused on regions with appropriate rock stratigraphy and evidence for ancient oxidation.

The new framework directs attention toward cratonic suture zones where supercontinent assembly between 1.6–1.0 billion years ago generated necessary thermal and structural conditions for ore enrichment.

Green Steel Demands High-Grade Ore

This exploration paradigm shift arrives as demand for high-grade iron ore intensifies due to steel decarbonization imperatives. Direct-reduced iron production, the cornerstone of hydrogen-based green steelmaking, requires feedstock exceeding 67% iron—a specification less than 15% of current global production meets.

The Hamersley model’s applicability could influence both future iron ore development geography and steel industry decarbonization pace.

How Scientific Research Became Sensationalized

The transformation of nuanced scientific revision into breathless “new discovery” claims illustrates how iterative simplification degrades factual fidelity. Commercial incentives, social media algorithms, and human psychology combined to prioritize emotional resonance over precision.

The absence of a singular public-facing discovery announcement created information voids that commercially oriented media filled with varying accuracy, prioritizing dramatic framing over chronological precision.

What Decision-Makers Need to Know

Australia’s iron ore dominance rests on decades of infrastructure development, operational expertise, and geological advantages that 2024 geochronology research enriches but doesn’t fundamentally alter.

Market evolution through 2027 will be shaped primarily by Chinese steel demand trajectories, Simandou’s production ramp, and steel industry decarbonization pace—not by billion-year revisions to formation age. The genuine scientific contribution deserves celebration while maintaining empirical rigor demands correcting cascading inaccuracies.

The Bottom Line

Western Australia’s Hamersley iron deposits represent Earth’s largest high-grade iron ore resources, valued at approximately $6 trillion at current prices. The July 2024 geological discovery revolutionized scientific understanding of formation timing but involved no newly uncovered deposits.

These mines have operated continuously since the 1960s, supplying nearly 40% of global seaborne iron ore. Market stability continues despite claims of disruption, with established supply chains absorbing incremental capacity additions.

Sources:

“A billion-year shift in the formation of Earth’s largest ore deposits.” Proceedings of the National Academy of Sciences (PNAS), July 2024.

“Ore-some: New date for Earth’s largest iron deposits offers clues for future exploration.” Curtin University, July 2024.

“Australia’s $6 Trillion Iron Ore Discovery Set to Transform Global Markets.” Yahoo Finance, June 2025.

“Global iron ore exports reached 1.6 billion tons in 2024.” GMK Center, March 2025.

“Iron Ore Statistics and Information.” U.S. Geological Survey (USGS), 2024.

“Resources and Energy Quarterly: December 2025.” Australian Department of Industry, December 2025.